Most thriving businesses know that competitor analysis is a ‘must-have’ and not a ‘nice to have’ since it helps you stay ahead of the curve. For your business, effective competitor analysis could provide valuable insights to enhance your offerings, understand tertiary markets, better meet market demands, and more.

And what’s the best tool to carry this out? Surveys. From crafting the right questions to applying insights savvily, we’re looking at the 10 steps you can follow to carry out a thorough competitor analysis via surveys.

Understanding the importance of competitor analysis through surveys

Competitor analysis is often confused with competitor watching, but in the former, you need to:

💡 Know who your direct and indirect competitors are

💡 Understand their strategies

💡 Do a SWOT analysis

💡 Determine how they position themselves in the market

With surveys, you can understand your competitors from the perspective that matters most — the customers. It helps you get actionable insights into what buyers think about your competitors, what they value, and where they believe there’s room for improvement.

Also, surveys are:

➡️ A barometer for understanding customer satisfaction levels with a competitor’s products

➡️ A great starting point for refining your offerings to meet market demands and acquire more customers.

➡️ Helpful in revealing market gaps your competitors haven’t addressed yet.

It’s important to note that surveys can only work when you ask the right questions — those that dig deep into customer perceptions, unmet needs, and potential weaknesses in your competitors’ strategies.

With well-crafted surveys, you can tweak every aspect of your business strategy, from product development to marketing campaigns, so you can track trends and stay ahead of them to meet customer needs.

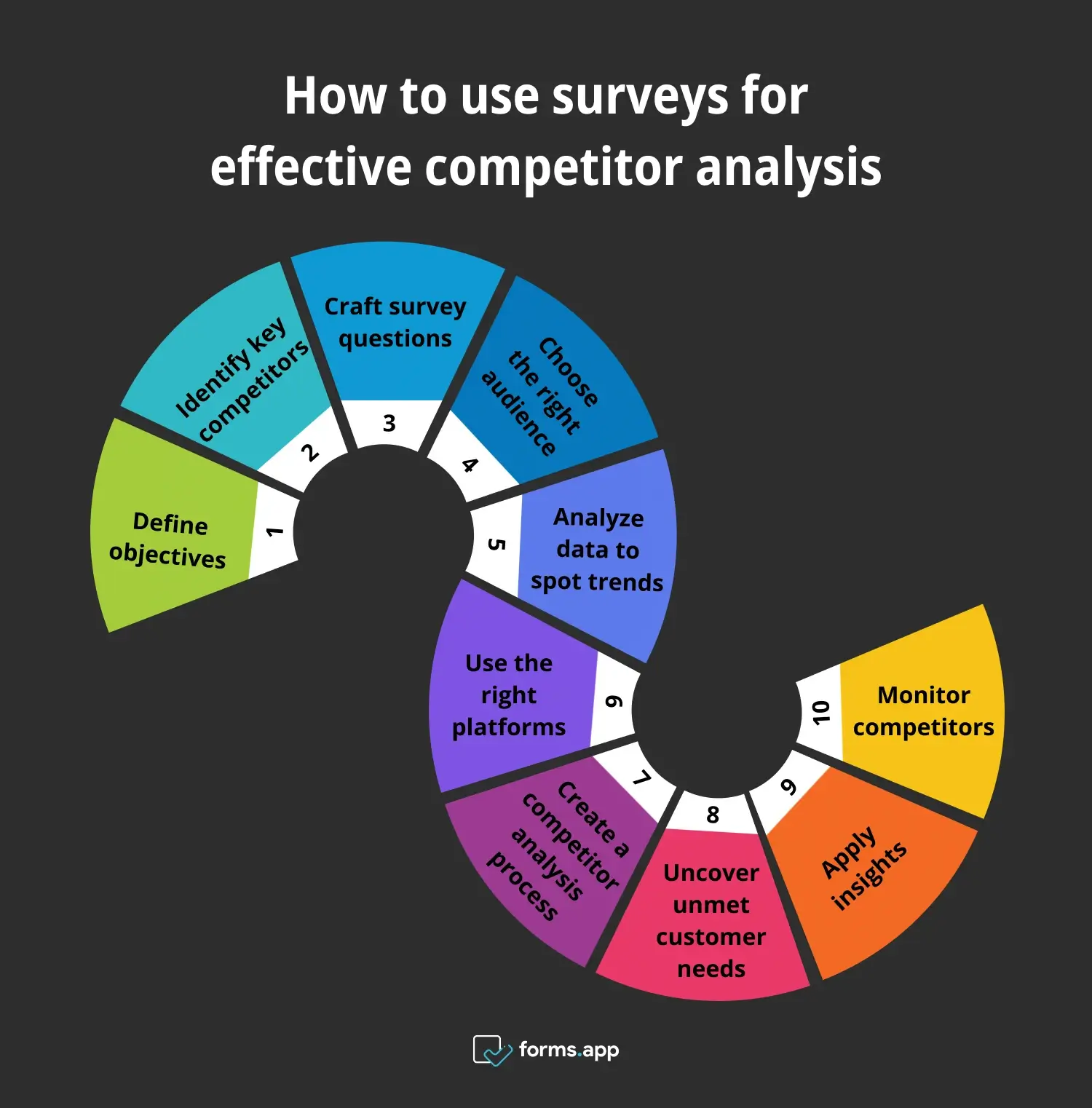

How to use surveys for effective competitor analysis

To understand the market you’re operating in at a granular level and gain situational analysis, follow the 10 steps below:

10 steps to use surveys competitor analysis

1. Defining your objectives for competitor analysis

You can’t conduct a competitor analysis before knowing your goal. With clearly defined objectives, you have a direction guiding your process. Conversely, without an objective, your data will be scattered, giving you unfocused insights that won’t help your strategy.

Some of your objectives could be:

- Understanding customer preferences

- Identifying gaps in competitor offerings

- Discovering new market opportunities

Suppose you want to understand why customers choose your competitor’s product. In that case, your survey should include questions that gauge customer satisfaction levels, their preferred features, and the areas where they think your competitor outdoes other brands in the niche.

Another key point to address during this stage is the framework you’ll use. Some important things to mention are:

🏢Company name

🌐Website link

🎯Mission statement

🗣Their elevator pitch

💰Offerings and pricing

👍Strengths

👎Weaknesses

🦄Brand differentiator or USP

You could update each point in a spreadsheet as you get more information. However, a simpler way would be to use templates to avoid missing out on crucial details.

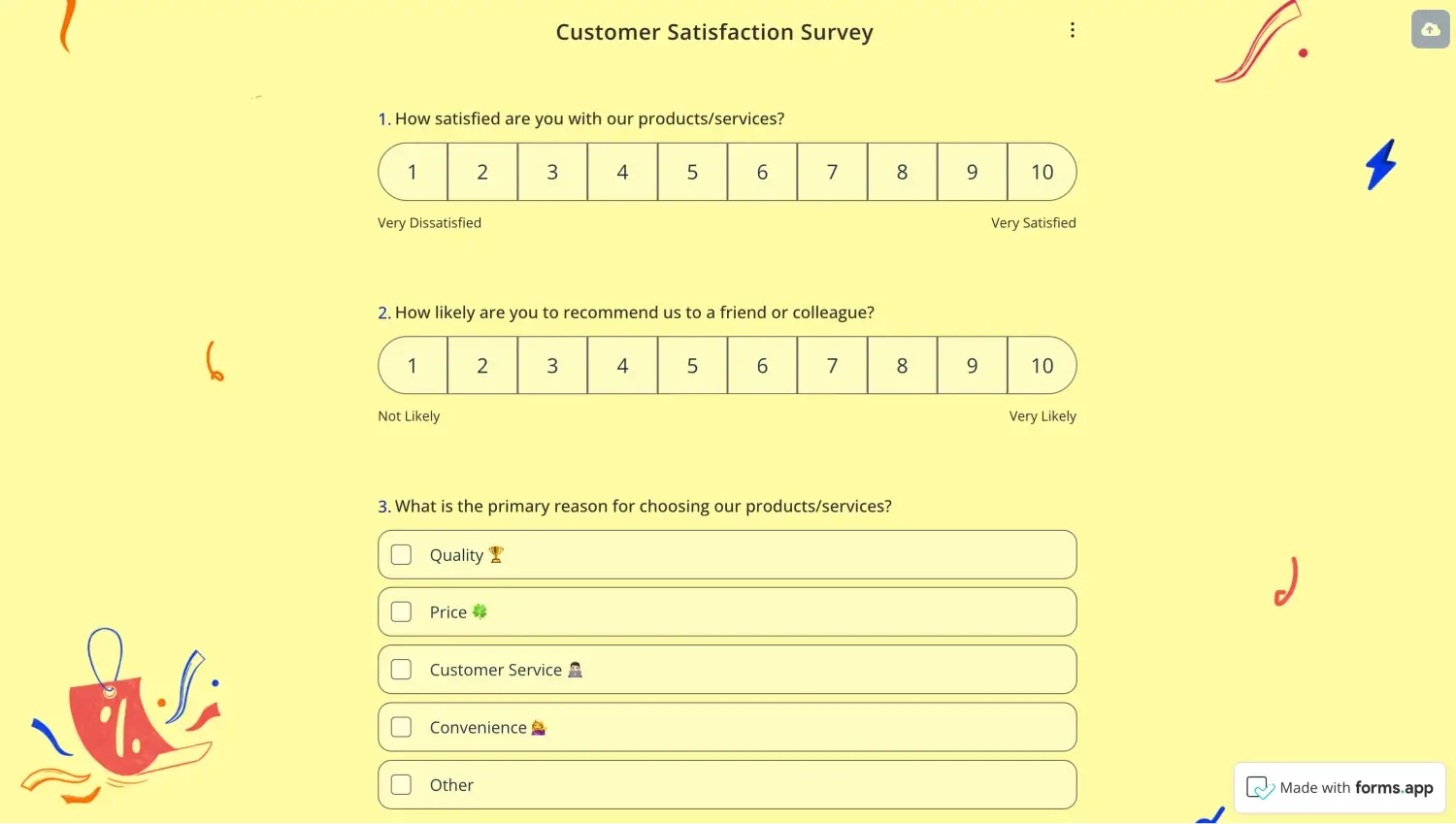

For example, if you’re looking to introduce a new feature, you would want to understand the similar features competitors offer and how customers feel about them. To do this, you could use a customer satisfaction survey template to help guide your product development strategy.

2. Identifying key competitors to survey against

While you may have multiple competitors, you must look for significant direct competitors to survey. This will make your insights more useful and relevant.

Start by identifying competitors who are direct threats to your business. These will include the ones offering products similar to your target market. They will most likely share your audience’s pain points, preferences, and buying behaviors.

Additionally, consider including market leaders, even if they aren’t direct competitors as your secondary competitors. Why? Analyzing industry leaders can help you set benchmarks and understand what causes success at the highest levels.

If your brand has a physical presence, you could survey local stores and compare them with national and/or global giants to understand what consumers like. For instance, bigger companies may fare well on variety, reliability, and a streamlined process. On the other hand, smaller businesses may be appreciated for their personalized service and unique product range.

Based on such information, you can position your brand better to offer the best of both worlds and then target both their markets.

3. Crafting effective survey questions

Don’t go about simply googling questions to add to your survey. Designing your competitive analysis survey is an art that needs a strategic approach so you can extract not-so-obvious insights. The key here is to include direct, unbiased, and structured questions to elicit clear, actionable responses. Start by considering what you need to learn about your competitors.

- Are you trying to understand why customers prefer their product over yours?

- Do you want to identify gaps in their offerings that you can exploit?

Or is it something else altogether? With these objectives in mind, you can formulate questions directly addressing these areas. Here are some questions you can include-

- What do you find most valuable about X?

- How likely are you to recommend X to others?

- If you could change one thing about X, what would it be?

- Why did you choose X over other options?

Such questions can shed light on your competitors’ strengths, weaknesses, overall satisfaction, areas of improvement, and customer loyalty. But remember, don’t ask leading questions since it can skew the answers and dilute your insights.

For example, “What, if anything, frustrates you about X?” is neutral and better than asking, “Why do you think X is inferior to others?”

If you’re struggling to frame the questions, try using an AI survey tool to get objective questions.

4. Choosing the right audience for your surveys

To state the obvious, your selected audience can impact your data. If you have disinterested respondents, your data will lack depth. Whereas, if you choose people with a well-rounded perspective, you’ll gain a practical understanding of your brand and competitors.

If possible, choose an audience that’s well-versed with your brand and your competitors. They can provide a comparative analysis and share insights into how your business stacks up against others. They can highlight what makes your brand stand out or where it may fall short so you have a clear direction for improvement.

You could also use a mix of existing buyers, potential customers, and industry experts since they can all offer different insights. While experts may not directly use your products, their deep market understanding can help you identify broader trends and shifts that might not be immediately obvious from customer feedback alone.

5. Analyzing survey data to identify trends

Pinpointing trends can reveal competitor advantages or areas where they may be vulnerable.

To do this, start by looking for recurring patterns in the responses. Are you noticing multiple respondents praise a certain feature? It’s a clear indicator of where your competitor shines. The same can be applied to negative comments.

Use data analytics tools to simplify the process. Tools like Tableau, Google Data Studio, or even advanced Excel functions can help you visualize the data and make it easier to spot trends that might not be immediately obvious from raw survey results.

For example, have you noticed how most of your competitors have a free trial option on their pricing page, or if they have more tiers? Maybe it’s time to test it out to see if it affects conversions.

6. Using the right platforms

Often ignored, evaluating how users perceive different platforms is crucial—especially when your business relies on these platforms for selling online. If you run an e-commerce store, comparing two platforms like Shopify vs. Etsy can determine which offers more value to your business needs.

For instance, Shopify is often praised for its customization and scalability whereas Etsy is known for being a strong community-driven marketplace, ideal for small businesses or individual sellers.

All this to say, survey customers who have used both platforms so you can gather data on their experiences, preferences, and the challenges they’ve faced.

7. Creating a process for competitor analysis

When you have a structured process for competitor analysis, you’ll get more consistent and accurate findings. It also comes with other benefits like:

- Scalability

- Better efficiency

- Clear communication

- Enhanced collaboration

- Easier onboarding for new team members

However, to ensure your team is well-equipped, you must invest in employee training and thorough process documentation, which standardizes the approach. You could use learning management systems to provide comprehensive and ongoing education for proper employee training.

8. Using surveys to uncover unmet customer needs

The ultimate goal of a customer needs survey is to understand what your audience is looking for and to gain a competitive edge. You can start by adding survey questions that explore specific dissatisfaction or underserved areas. It could include questions like:

- What features do you wish X brand had?

- What challenges are you facing that X hasn’t addressed to your satisfaction?

Such direct questions highlight where your competitors fall short and don’t meet customer expectations. With this information, you can improve your offerings and position your business as the better alternative.

For example, trying a new tool can be met with reservations. Buffer used this to their advantage and gave new users free trials to target Hootsuite’s audience.

Even the smallest detail counts and can help you draw in your competitors and new audiences.

9. Applying survey insights to refine your strategy

At this stage, your data comes to life. Acting as a roadmap to strengthen your market positioning, your targeted approach to improve your overall business will start appealing to buyers looking for better alternatives.

You’re only as limited as your objectives. So, to maximize the insights you can gain from the competitive analysis survey, try to look at these areas:

- Product development

- Marketing strategies

- Customer service improvements

- Pricing strategies

- Feature prioritization

- User experience design

- Competitive positioning

- Sales tactics

- Brand messaging

- Innovation and R&D initiatives

When you steadily refine your strategies across different areas, you’ll keep up with your competition and actively surpass it. This will eventually lead to higher customer satisfaction, loyalty, customer lifetime value (CLV), and, ultimately, ROI.

10. Continuously monitoring competitors through surveys

Since the market’s dynamics keep changing, what was true last year may not be applicable this year or the next.

When you regularly survey customers, you can track shifts in their preferences, notice emerging trends, and modify your competitor strategies. Remember, you don’t always have to reinvent the wheel. Sometimes, just moving the needle in the right direction is all it takes to uncover valuable opportunities.

Get started with surveys today

Whether you aim to understand customer preferences, discover unmet needs, or benchmark against industry leaders, surveys are a great way to gather actionable data. They help you learn about your competitor’s strengths, weaknesses, and market opportunities.

When you uncover detailed insights, you can use the data to refine your business strategies, better position your products and offerings, and find new markets to enter. The first step towards gaining a competitive edge is defining your survey objectives and unlocking insights.

Ready to get started?

forms.app, your free form builder

- Unlimited views

- Unlimited questions

- Unlimited notifications