You’re a startup. You want your product or service to succeed and your market position to rise, but where do you start? Market research can give you a good foundation, but it’s essential to know what type of research to do and how to perform it effectively.

In this article, you’ll learn the ins and outs of market research. We’ll discuss the types, how to research the right way and analyze and convert the data into a successful strategy. Finally, you’ll see examples of market research surveys in action, so any lingering mystery behind conducting market research for your brand will be a thing of the past.

What is market research?

Market research is the process of gathering, analyzing, and interpreting information about a market. This includes details about the target audience, customer preferences, and competitive landscape.

Why is market research essential for startups?

Market research is even more important for startups because they’re starting from scratch and need key information to better understand the market they’re entering.

This information helps startup owners better understand their customers, what they value, and how they make purchasing decisions. This includes what motivates them, keeps them up at night, and makes them choose one product over another. That way, startups can develop products and services that meet real needs, stand out in a crowded market, and increase their chances of long-term success.

Plus, when you know your customers inside and out, you can anticipate your needs, adapt to changes, and keep growing.

Ultimately, market research is all about turning the data you gather about your customers and the overall market into a roadmap or compass that guides every business decision.

Types of market research

There are two main market research types: primary and secondary. From the table below, primary research involves collecting original data directly from the source. It gathers fresh information from potential customers, competitors, or the market environment. This type of data collection can be quite high compared to secondary research, but it allows for great customization.

Conversely, secondary research relies on existing data, which makes it more affordable. However, this also makes it more difficult to tailor to specific needs.

| Primary Research | Secondary Research | |

| Data Collection | New, original sources | Existing secondary sources |

| Cost | High | Low |

| Level of Customization | High | N/A |

1. Primary research

We can divide primary market research into two main categories: quantitative and qualitative research. Each type serves a different purpose, but together, they provide a comprehensive view of the market. Quantitative research looks at numerical data using statistical methods. Qualitative research investigates social reality by examining non-numerical data.

a. Quantitative research

During quantitative market research, you collect numerical data that you can analyze statistically. It focuses on the “what” and “how many”. This is an excellent method for identifying patterns, measuring customer preferences, and making predictions based on large sample sizes.

For example, you might distribute surveys to a large group of potential customers to measure their interest in a new product. The results show that 70% of respondents would likely purchase the product at a specific price point. Ultimately, you get a solid basis for pricing and production decisions.

b. Qualitative research

Qualitative research focuses on understanding the underlying reasons, opinions, and motivations behind customer behavior. When conducting qualitative research, you can use interviews, focus groups, and open-ended surveys.

These methods provide rich, detailed insights. For example, imagine your startup conducting in-depth interviews or focus groups to understand why customers prefer a competitor’s product or what motivates them to purchase. You’ll likely receive detailed, narrative-rich data that helps uncover the emotions, attitudes, and perceptions that drive customer behavior.

2. Secondary research

Secondary research uses existing data to gain insights into industry trends, customer behavior, and competitive landscapes. This is data that others have published. Secondary research is an excellent option if you want to gain a basic understanding of the market without the need for extensive resources. The types of secondary research sources you can use include:

- Public sources: Government reports, industry studies, and academic papers are examples of public sources. You’ll usually find them through reputable organizations like the World Bank or the U.S. Census Bureau. Public sources can provide information on economic indicators, demographic trends, and industry performance. And the best part? You can usually access them at no cost.

- Commercial sources: Commercial sources are data and reports from market research firms, industry analysts, and trade associations. You usually have to pay for these reports, but they offer in-depth analysis and insights you’ll need to understand specific market or competitive dynamics. For example, purchasing a report from a firm like Gartner or Nielsen could get detailed market forecasts or consumer behavior analysis within a specific industry.

- Internal sources: Internal sources refer to data your company already has. This could include sales records, customer databases, or previous market research. You can use this information to understand past performance, customer preferences, or regional sales trends.

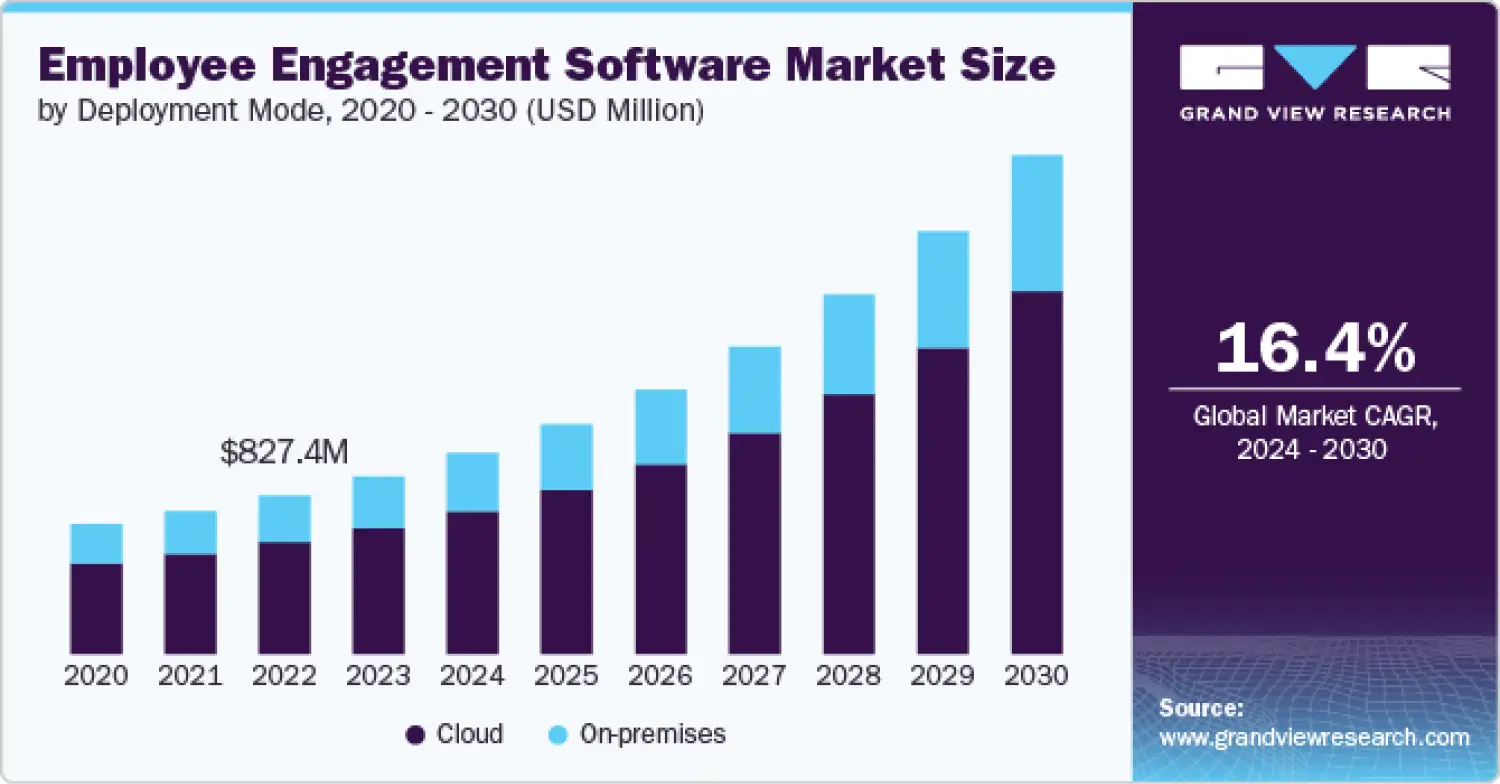

Let’s look at an example of how you’d conduct secondary market research. You’re launching an employee engagement tool. So, you decide to review existing industry reports to understand market size, growth projections, and key players.

Below are screenshots from a report from market research firm Grand View Research that provides an overview of the employee engagement software market.

You can see the compound annual growth rate (CAGR), and global market size based on deployment use and end-use. This helps you predict future trends and understand the industry's overall potential depending on the industry you will market to.

Statistics about employee engagement software market size

How to do market research

Beyond deciding whether primary or secondary research is right for you, you’ll need a process to follow to ensure your research hits the mark. In the following sections, we’ll go through, step-by-step, and discuss how to conduct market research for your startup. Get ready to find your competitive edge.

Steps for market research

1. Define the reason for your research

Why are you performing market research? A clear purpose guides every aspect of your research, from choosing suitable subjects to asking the most relevant questions. This clarity keeps your research focused. It also ensures that your results provide actionable insights aligning with your objectives. So, define your reason for research. Ask yourself what specific question you need to answer or what problem you want to solve.

- Identify your business goal. Are you trying to validate a new product concept, identify a new target market, or understand why sales have dropped?

- Pinpoint specific objectives. Break down your overarching goals into particular objectives. For example, if you’re validating a new product idea, your goals might be understanding customer needs or gauging potential demand.

- Determine the scope. Determine how broad or narrow your research should be. This will ensure that you gather only the most relevant data.

- Formulate research questions. Based on your objectives, create questions to help you gather the necessary information.

Consider this example: You want to launch a startup that offers co-working spaces. Your goal for conducting market research is to see how consumers feel about their commute to work.

If there is negative sentiment, this might reveal a potential opportunity to alleviate commute-related stress by providing co-working spaces near residential areas. This means a shorter and more convenient commute.

Below is an example of a survey question you might use to understand the market need for your solution.

2. Hone in on your competitors and your target market

Analyze your competitors to identify key players in the market. Look at their offerings. How well do their products or services align with the needs of your target audience? This will help you pinpoint areas where your competitors excel and where they might fall short.

Study their marketing channels, messaging, or customer engagement strategies. Understanding where and how your competitors connect with your shared audience will help you uncover gaps or opportunities to capture attention in ways they may have overlooked.

3. Choose the right type of research to conduct

Primary research and secondary research both serve distinct purposes and offer unique insights. Knowing which is best for your purposes will help you get the highest quality results. For example, primary research is great for gathering specific information tailored to your research needs. But if you’re looking for something more cost-effective that provides quick access to a broad range of information, secondary research may better suit your needs.

If you choose to conduct primary research, make sure you select the right participants. Try to include at least 10 participants per buyer persona. This sample size will ensure the insights you gather are representative and diverse enough to capture a range of perspectives.

You should also include participants from diverse backgrounds. This will allow you to see different customer needs, preferences, and challenges.

4. Conduct your research

You made it. You’re finally ready to dig in and do some research. Depending on whether you’re using primary or secondary research, you’ll need some tools to help you get started. If you’re doing primary research, you can use forms, surveys, polls, and other templates to gather relevant data. Design neutral and objective questions to avoid potential bias or leading respondents toward a particular answer.

Identify and recruit participants from your target market. Pilot test your research instruments to ensure straightforward questions and effective methodology. Then, do a soft launch with a smaller target audience segment. After monitoring the results and making adjustments, roll out the research to your entire sample.

If you’re using secondary research, you can use tools like market research studies and reports, books, surveys, and case studies. Tools like ResearchGate and Academia that connect you with scientists and other researchers can be game-changers.

Storing and organizing your data during research is crucial and will make analysis a much simpler process when the time comes. You must consider various priorities regarding data storage, including:

- Accessibility for your team

- Data security

- Compliance

- Integrations

Solutions to data storage range from simple hard drives to complicated cloud solutions. For companies performing extensive market research and collecting huge amounts of data, a comprehensive solution makes sense. That’s where a data security posture management (DSPM) system shines. It lets you rest easy knowing your valuable insights are secure and ready when you need them. You control who can access the data, and if needed, the DSPM can produce regulatory compliance reports.

5. Analyze your results

Data’s worthless unless you do something with it. The analysis makes the data sense, turning raw information into clear, actionable insights. If you have numerical data, you’ll analyze it statistically to give you projections and predictions. If you have non-numerical data, you’ll analyze it qualitatively — perhaps socially or behaviorally — to learn about your customers’ behavior, such as purchasing patterns and preferences. Both types of data and analyses are valuable.

Here’s how to organize your findings:

- Industry overview: Market landscape (e.g., industry size, growth, key players, current trends, tech advancements, regulatory factors), competitive environment (e.g., major competitors, their market positions, strengths/weaknesses)

- Projected market share: Market segmentation (e.g., demographics, geography, product categories), market share estimates (e.g., estimates of potential revenue, market penetration rates, comparisons with competitors)

- Customer buying trends: Consumer preferences (e.g., buying patterns, preferred product features, factors influencing purchase decisions)

Use the insights you gained for different purposes, such as strategic planning, product development, marketing strategy, and financial planning.

6. Build an action plan according to your insights

Creating a clear action plan after gathering insights from your market research is crucial. List specific tasks, like improving assembly instructions if users find them confusing, and make sure each task addresses a key need identified in your research. You might also choose to conduct research on industry best practices for creating compelling product manuals.

This will help reduce user overwhelm during product assembly. After developing an action plan, set a timeline and decide how to measure success. Remember, passion and persistence are essential. Sticking to your plan with determination will help you stay on track and reach your startup goals.

Examples of market research survey

forms.app offers a variety of market research survey templates to help you streamline the market research process. Here are three different templates you can use in your market research to help you collect data:

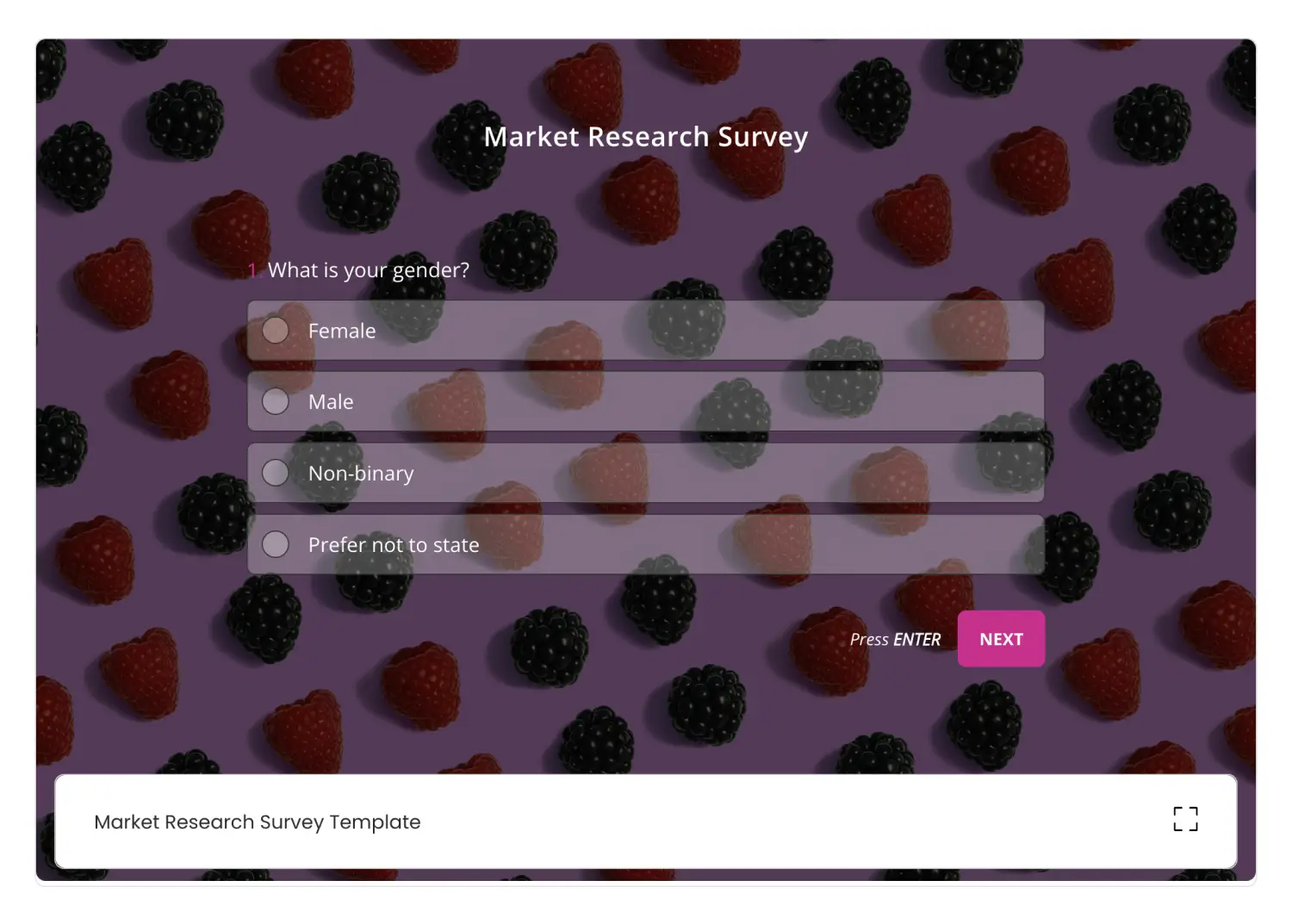

Market research survey

Market research survey template

The market research survey template lets you gather insights into market trends, customer preferences and demographics, and potential demand for new products or services. Use it to analyze responses, identify target market segments, and refine product offerings.

You can also include market research questions about your brand to determine how customers perceive your company and whether you need to improve your brand reputation.

Product research survey

Product research survey template

The product research survey template helps you survey the market before you launch a new product. This will help you understand what the market needs and wants and whether your product will meet those needs and be successful.

Ask questions about products currently on the market and how your product compares. Keep your product survey questions clear and simple.

Customer needs survey

Customer needs survey template

The customer needs survey template allows you to ask your customers about their preferences and user experiences with your brand. It provides a customizable template for customer feedback, allowing you to learn whether they’re satisfied with your product or service. This feedback will allow you to make necessary adjustments to improve your offerings and protect your brand reputation.

Simplify your market research

The value of market research is clear. It provides you with the information you need to make strategic business decisions. This is non-negotiable for a startup. Since you’re new to the market, you need key insights about your customers and competitors to establish a strong position and gain market share.

In this article, we shared the types of market research, essential steps to follow, and examples of market research surveys. Now that you have seen all the details with pinpoints, you are ready to streamline your market research!

Işılay is a content writer on forms.app. She is passionate about advertising. This passion comes from the fact that she likes to make things interesting for people. She loves reading and writing. Işılay specializes in marketing, survey types, and program management.