As a startup founder, you're no stranger to the constant challenges accompanying every growth stage. But fret not. Surveys for startups can be powerful tools. They help you navigate these hurdles by providing valuable insights to guide your decisions.

Today, we'll share our curated list of must-have surveys according to common startups’ use cases to fuel your business growth. No matter where you are on the business pyramid!

The survey you need depends on the outcome you are seeking

When contemplating the launch of a new product or service, conducting surveys allows you to gauge demand and identify real-market needs for your startup. This approach ensures strategic decisions are grounded in actual customer feedback, increasing the chances of success. 🚀

However, the choice of the right survey shouldn’t come before knowing your specific goals and the areas of your business where feedback is needed. Let's explore some common survey purposes for startups and the outcomes they can help you achieve.

Understanding your market

Once you have gathered as much information as possible through secondary data collection methods - either from internal or external sources, such as existing research and reports -, the next vital step is to conduct a market research survey.

Market research surveys enable you to craft well-informed questions and directly engage with your target audience. They’re essential for gaining insights into your target market, creating an outline profile of the audience, and knowing your competition. They serve as the foundation for your product discovery and for making informed decisions that shape marketing strategies, for instance, making it crucial to invest ample time in their preparation.

Understanding your audience

Demographic data is readily available and highly valuable in shaping your strategies. It encompasses information such as age, income, family composition, and education level. Although it may seem straightforward, this data holds significant importance.

Clear demographic information enables you to make informed assumptions about your audience's preferences and habits. For instance, if your target market consists of college students, incorporating references to college life in your marketing or placing your product in places or timings that align with college life can benefit your efforts greatly.

Likewise, understanding your audience's needs allows you to communicate ideas without overly detailed explanations. Suppose the majority of your audience consists of individuals with young children. In that case, emphasizing how your product is also family-friendly can greatly appeal to them.

When used effectively, demographic data gathered from surveys can be a powerful tool in testing approaches and shaping multiple strategies.

Uncovering price sensitivity

Refers to how customers' willingness to pay is influenced by the cost of a product. In simple terms, it determines the potential profit you can gain by adjusting your prices. Many businesses tend to overlook the importance of pricing, often opting to mimic their competitors.

While this approach, or other known pricing techniques, may lead to profitability, it typically means leaving potential revenue on the table. Conducting a price sensitivity survey allows you to understand exactly which product features resonate with different customer segments and how much they are willing to invest.

With this information, you can design pricing packages that align with the needs of various customer segments and have a higher chance of not only conversion but brand acceptance from your different audiences, making them feel heard and understood.

Achieving product-market fit

What's crucial for making a product successful? The answer is something you already know, back when you decided to create something new. Go back to that. It’s all about how your product solves the users’ problems and what it means to them - while constantly improving it over time, but more on that later.

The thing is, you can't do that without understanding your audience and customers. That's what it takes to achieve that sweet spot called "Product-market fit." It revolves around a single question:

"How would you feel if you could no longer use this product?"

Typically, respondents can choose from four options:

1 - Very disappointed

2 - Somewhat disappointed

3 - Not disappointed (it isn't very useful)

4 - Not applicable — I am no longer using the product.

According to Sean Ellis’ popular 40% rule, if around 40% of people respond with "very disappointed," it may indicate that you have achieved product-market fit because your audience wouldn’t use an alternative to your product - it resonates strongly with your target market.

Harnessing the power of product feedback

While order frequency and reviews can provide some information about your product, they often fall short of delivering the concrete insights necessary to drive significant improvements. To truly understand what resonates with your customers and make informed decisions, a product feedback survey is essential.

A well-designed product feedback survey allows you to gather valuable information about what aspects people appreciate and/or dislike and the underlying reasons behind their sentiments.

Consider including open-ended questions in your product feedback survey. Here’s a sneak peek of some suggestions — we’ll dive into them later on:

1 - What were your initial impressions of the product?

2 - Do you believe the product offers good value for its price?

3 - In what areas do you feel the product could be improved?

4 - Where does the product excel?

By encouraging respondents to share their experiences and thoughts, you gain deep insights into your product's strengths, areas for improvement or change, and overall customer satisfaction — all of which will help you stay relevant and achieve product-market fit, as mentioned before.

Measuring customer loyalty

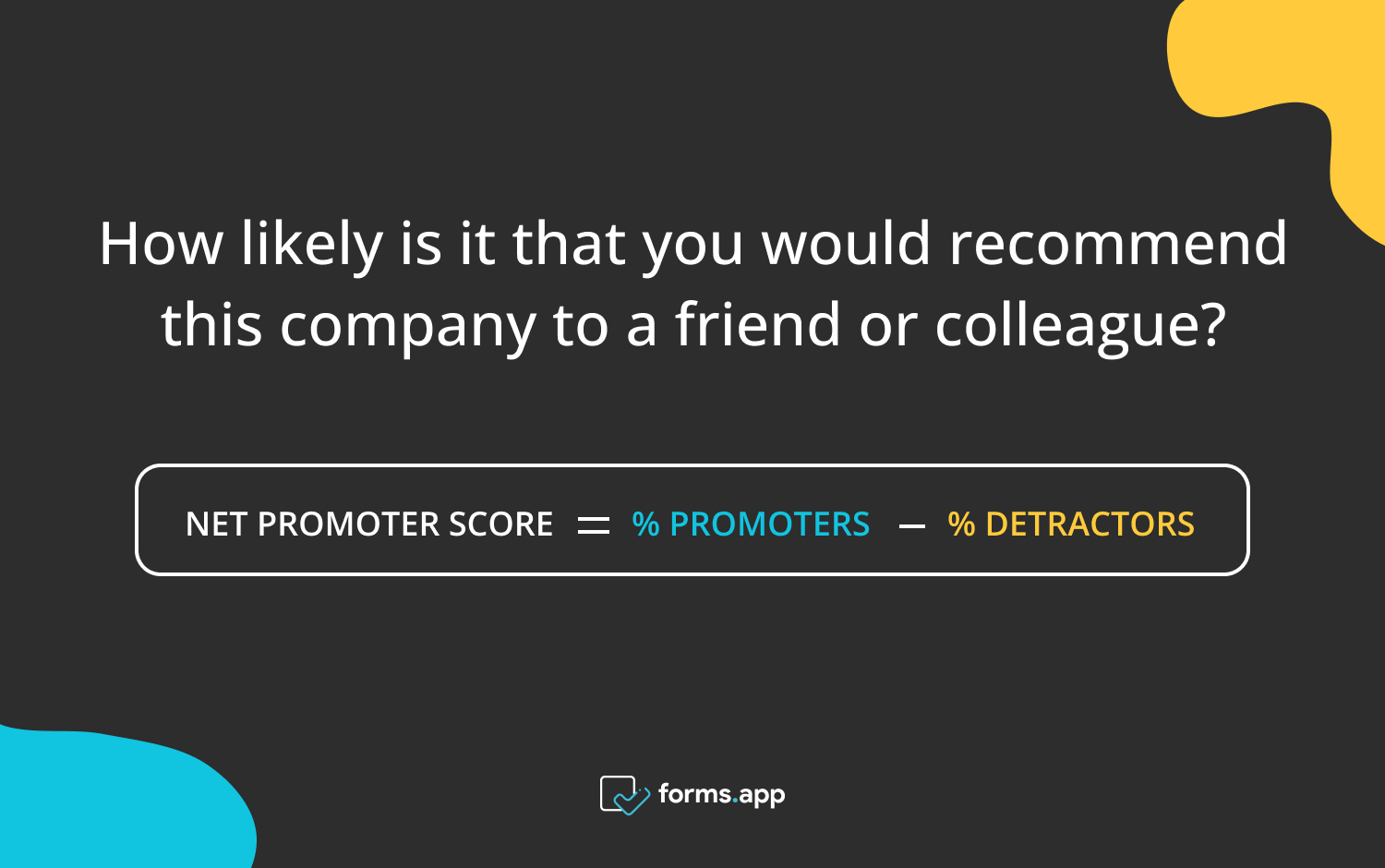

The Net Promoter Score (NPS) survey, developed by Fred Reichheld of Bain & Company, serves as a valuable tool for assessing customer loyalty towards your brand. It combines a concise, scaled question with an open-ended inquiry that allows deeper insights.

The beauty of this survey lies in its simplicity and directness, allowing you to quantify results with a score. However, it's important to recognize that this survey offers only a single data point.

The key question asked in the NPS survey is as follows:

"How likely are you to recommend our product/company/service to your (friends/family/colleagues)?"

NPS formula

Respondents can select a rating between 0 and 10. Ratings of six and below classify them as detractors, while scores of 7-8 are considered neutral, and ratings of 9-10 identify them as promoters.

But here's the thing: the real value comes from what we do with this data. We don't just stop at the score; instead, we use it consistently over time to track changes and trends.

Now, the best part is the follow-up questions. Based on their response, we can dig deeper and ask them what we're doing right and what we can improve. That's where the magic happens – we use this feedback to make our customers even happier and more loyal to our brand.

For startups, these surveys are not just about numbers; they are about building strong customer loyalty. And you know what that means? Happy customers, better team performance, and improved internal communication. So, let's dive in and harness the true power of surveys to propel your startup to success.

5 surveys you will need

Now that you're more familiar with the goals and needs of startups - and might have even recognized some situations from your own experience -, we've selected 5 surveys to be your trusted allies. They'll be your tools for transforming your vision into reality through insights shaped by accurate and reliable data, which, from our experience, might just inspire pivoting light bulb moments once in a while.

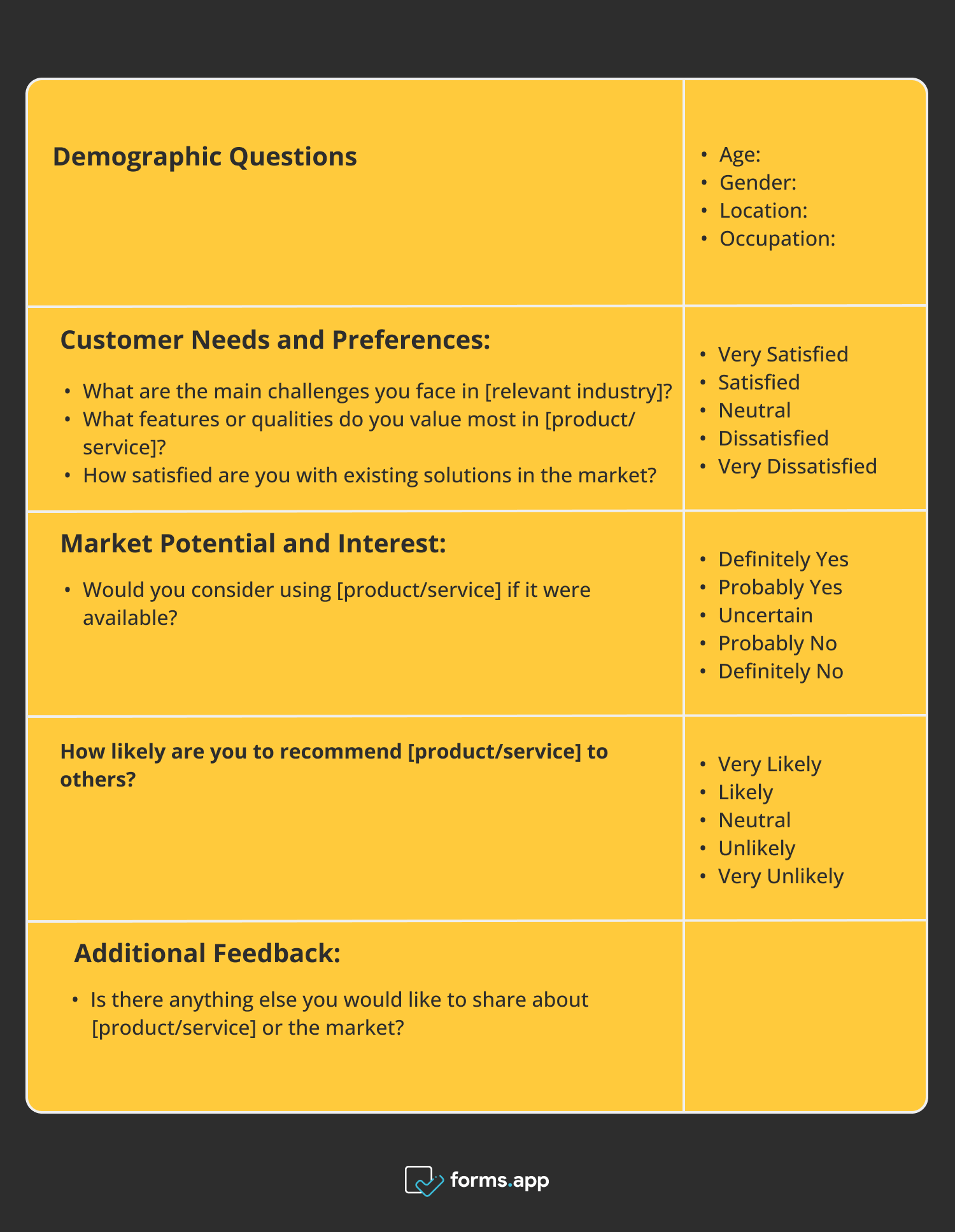

Market research survey

A market research survey is self-explanatory considering the intended outcomes mentioned previously: it’s designed to help businesses understand their target market, assess customer needs and preferences, and identify opportunities for growth or market fit. By gathering valuable insights through this survey, you can align your products or services with market demands and make sure they are relevant to the consumers.

Make informed decisions for your startup with a ready-to-use Market Research Survey Template, providing a valuable framework to gather essential insights from your target market.

Sample Structure and Questions for a Market Fit Survey:

Sample structure and questions for a market fit survey

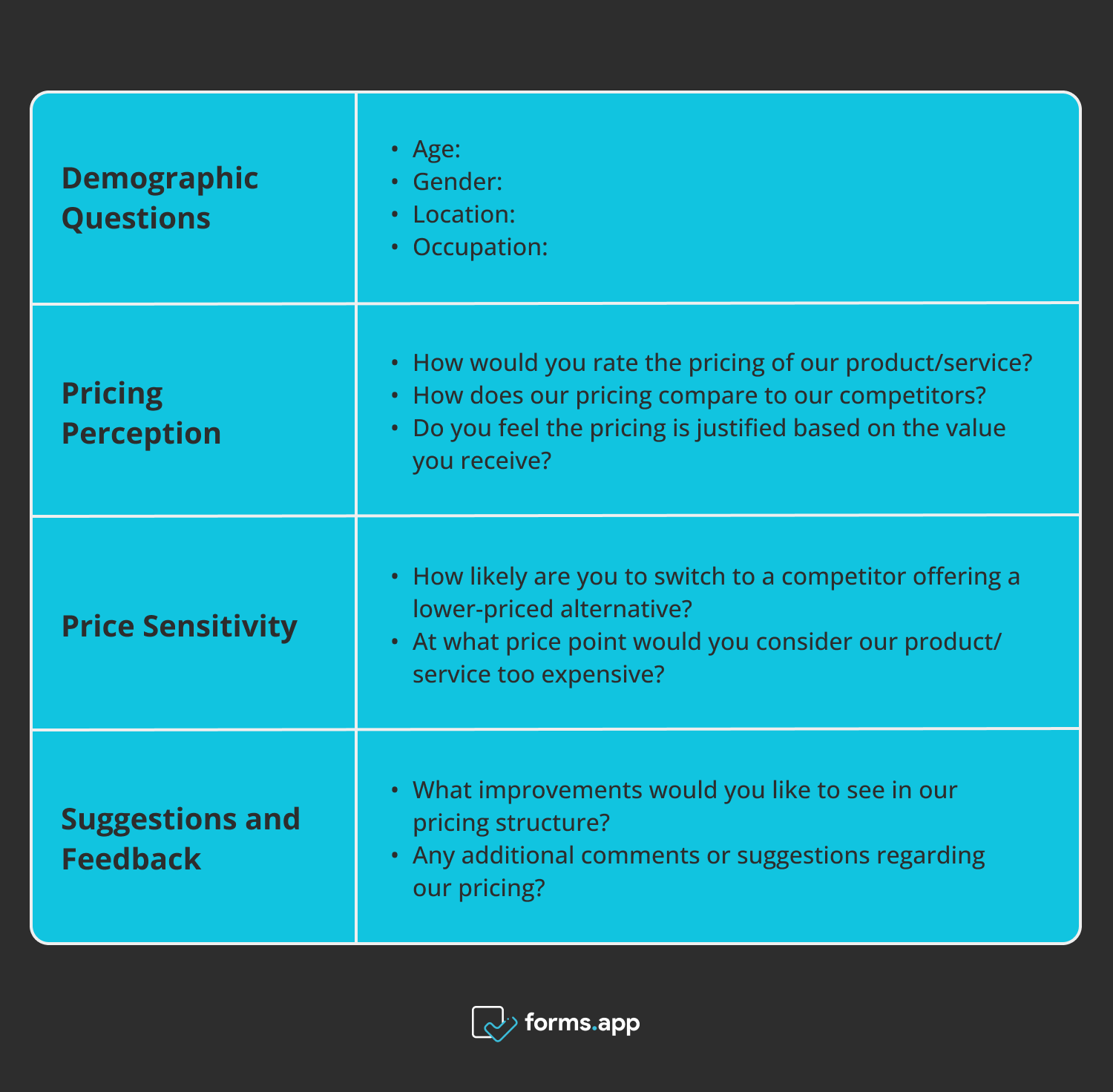

Pricing survey

A Pricing Perception Survey aims to gather valuable insights into how customers perceive your product or service pricing. By understanding their perceptions, you can fine-tune your pricing strategy to maximize value and profitability.

Streamline your pricing strategy with a tailored Pricing Survey Template, enabling you to gather crucial feedback and set competitive prices that resonate with your customers.

Sample Structure and Questions for a Pricing Perception Survey:

Sample structure and questions for a pricing perception survey

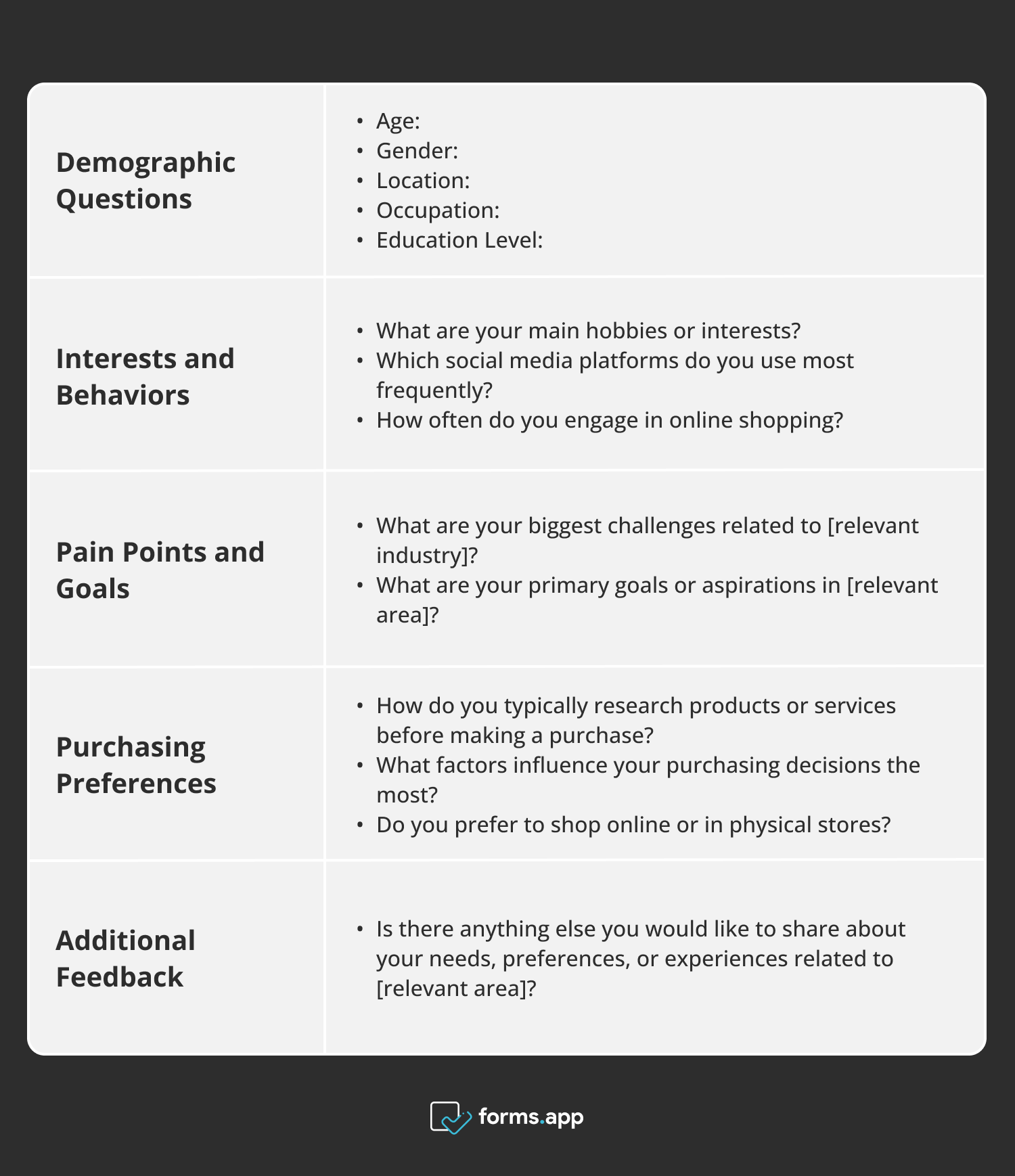

User persona survey

User Persona Survey is designed to help businesses create detailed profiles of their target audience, also known as user personas. 👥 By gathering essential information through this survey, you can gain deep insights into your customers' characteristics, needs, and preferences, enabling you to tailor your products or services, marketing strategies, and messages to engage and meet their expectations effectively.

Sample Structure and Questions for a User Persona Survey:

Sample structure and questions for a user persona survey

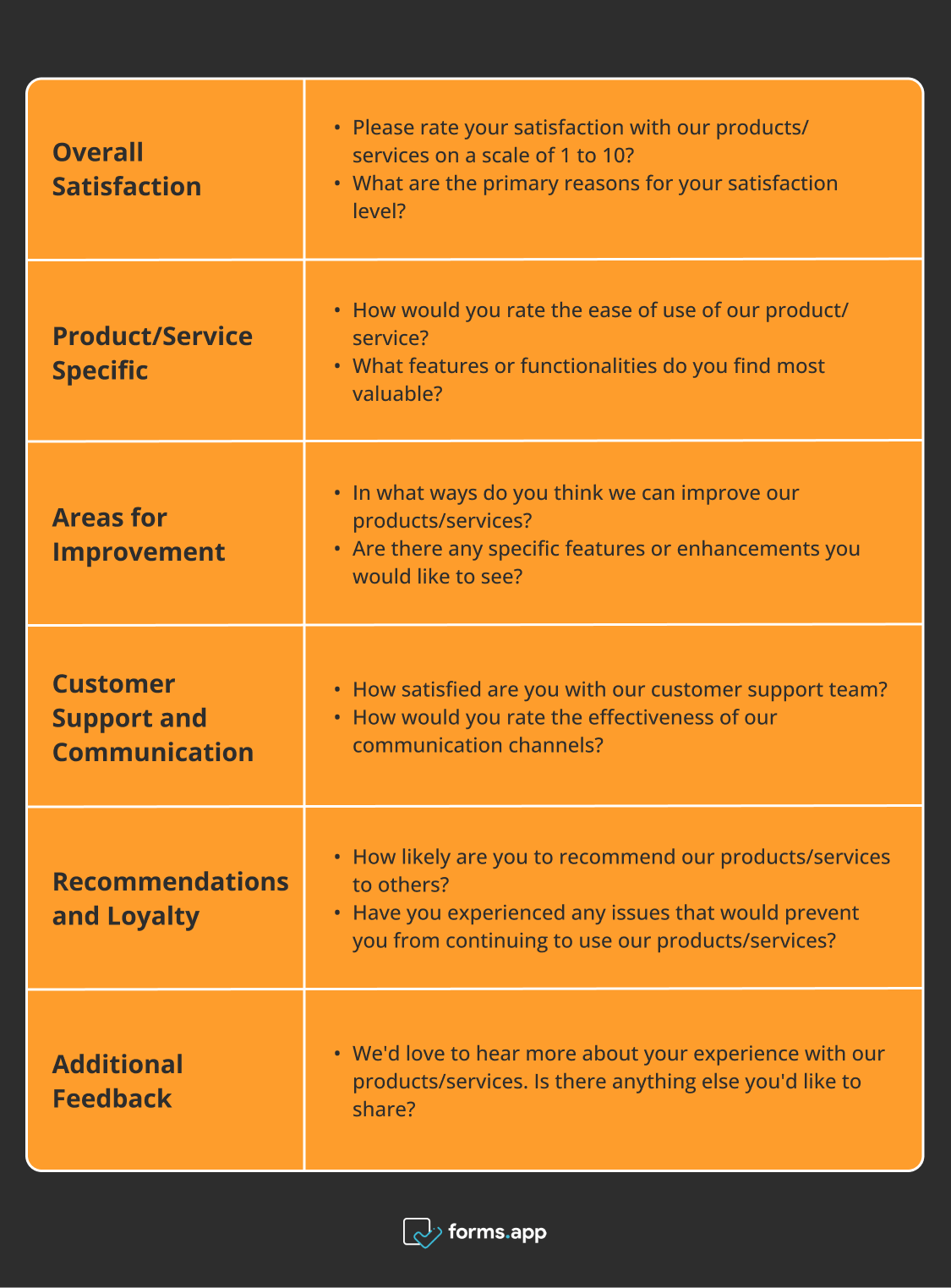

User feedback survey

User Feedback Survey enables businesses to collect valuable insights directly from their customers. By gathering feedback through this survey, and ideally armed with the information you’ve collected from the previous User Persona Survey, you can understand customer experiences, identify areas for improvement, and make informed decisions to enhance your products, services, and overall customer satisfaction.

Enhance your business's customer satisfaction and growth with Customer Feedback Form and Client Feedback Form Template.

Sample Structure and Questions for a User Feedback Survey:

Sample structure and questions for a user feedback survey

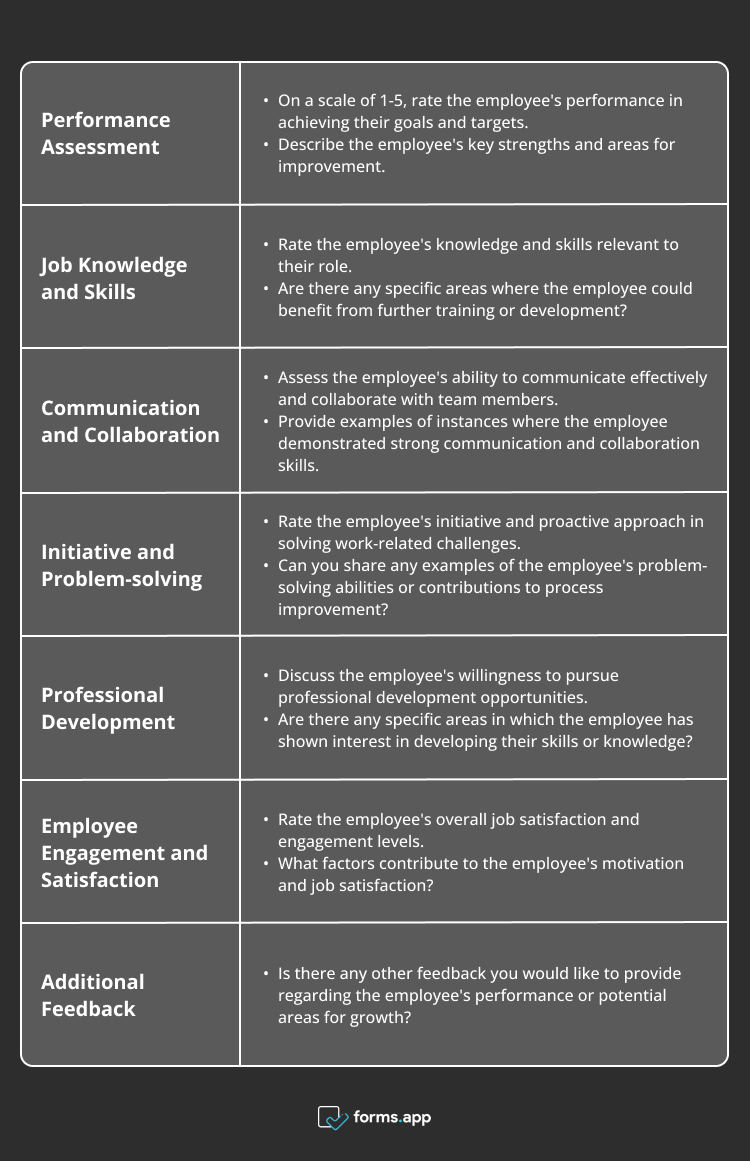

Performance evaluation survey

Performance Evaluation Survey assists HR professionals in assessing employee performance, identifying strengths and areas for improvement, and promoting growth and development within the organization. By gathering feedback through this survey, HR or Internal Communications teams can make data-driven decisions, recognize employee achievements, and foster a culture of continuous improvement and productivity.

Elevate employee engagement and create a thriving workplace culture using these Employee Satisfaction Survey Templates.

Sample Structure and Questions for a Performance Evaluation Survey:

Sample structure and questions for a performance evaluation survey

How to make use of the fresh data

Once you've collected qualitative and quantitative data through surveys for startups, the time comes to effectively collect insights and use that data to make informed decisions and achieve your desired outcomes, as we mentioned before — or even unexpectedly surpass your initial expectations and plans.

Analyzing data and segmenting

Start by analyzing the collected data to identify key patterns and trends. This involves processing both qualitative and quantitative feedback. Organize the data into meaningful segments based on demographics, preferences, behaviors, or other relevant factors for your startup. This segmentation enables a deeper understanding of different customer or employee groups, facilitating more targeted and effective actions.

I've got some great tips for you to consider in this step:

1 - Clean up your data: Before anything else, make sure to remove any duplicate or incomplete records from your survey data. This will ensure you're working with accurate and reliable information.

2 - Visualize your data: To make things easier, use a data visualization tool like Coupler.io, Tableau, Microsoft Power BI, or Google Charts. The visual aid will help you interpret the data more intuitively, making it simpler to spot trends and patterns - and also share them with your teams.

Go the extra mile and turn it into a product development dashboard by keeping it updated. This will help a great deal with product development decisions and cross-functional collaboration.

3 - Try different segmentation methods: Remember, there's no one-size-fits-all approach to segmentation. So, don't be afraid to experiment with various methods to find what works best for your specific data, product, and desired outcomes.

4 - Stay flexible with your segmentation: Your customer base and product will grow and might change over time — and that's okay! Be ready to adjust your segmentation criteria accordingly. Don’t quit getting to know your audiences.

BRIDGeS framework

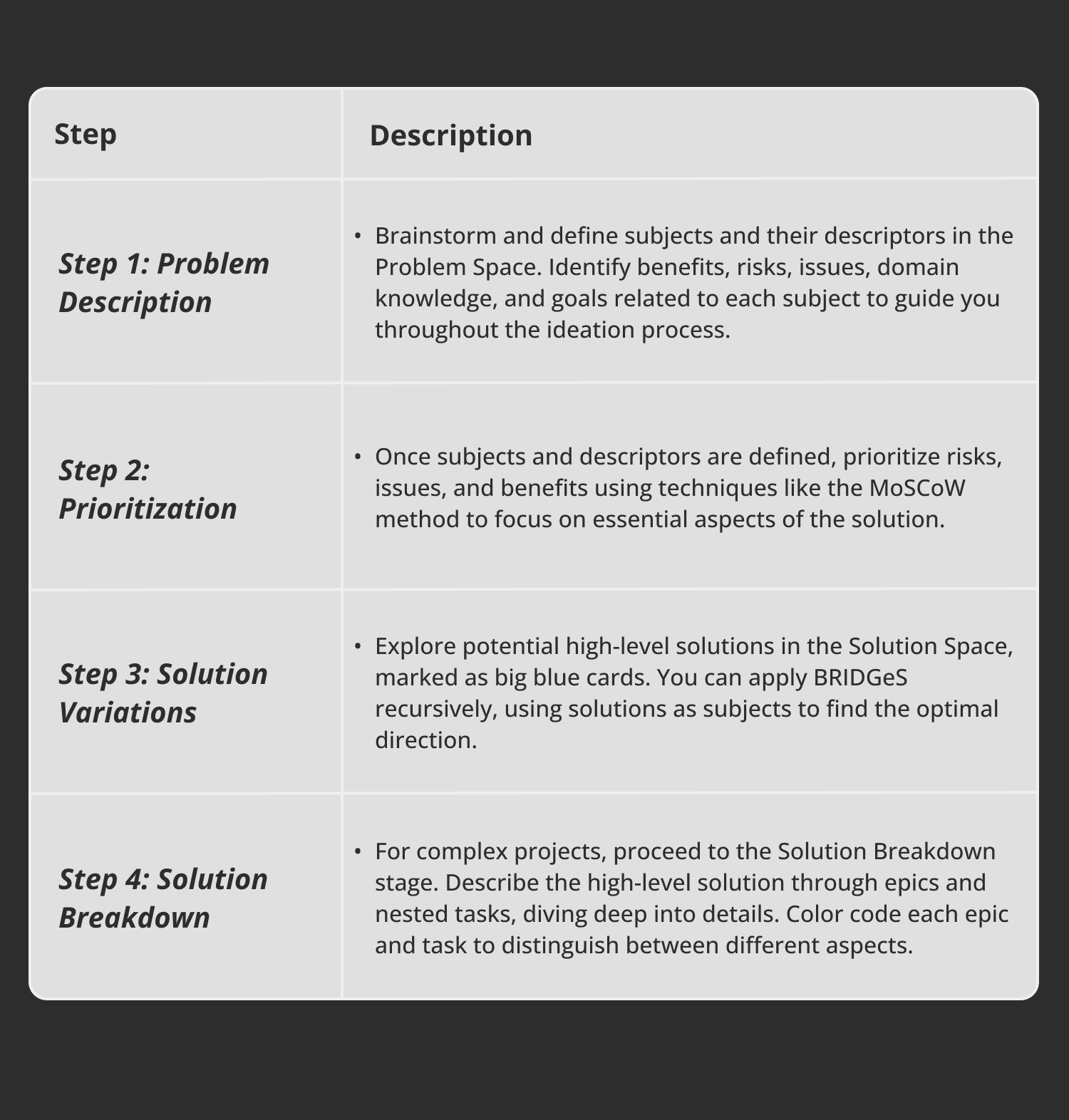

The BRIDGeS approach is a simple yet super effective way to get those comprehensive insights from qualitative data. You won't need any fancy certifications or tons of resources for this – it's all straightforward and actionable with just four easy steps.

BRIDGeS framework

You get that optimal solution you've been looking for, and it comes with crystal-clear instructions on what to do next. Whether you're dealing with non-product stuff or brainstorming new product ideas, BRIDGeS gives you a roadmap to make it happen.

Collaboration and action planning

Engage relevant stakeholders, such as cross-functional teams or department heads, in collaborative discussions to share and discuss the data insights. Foster a cross-functional environment that encourages open dialogue and brainstorming. Together, identify areas for improvement and develop action plans to address challenges or capitalize on opportunities revealed by the data.

Continuous monitoring and iteration

Establish a system for ongoing monitoring and evaluation to track the impact of implemented actions. Regularly review the data and metrics to assess the effectiveness of strategies and initiatives. Adjust and iterate as necessary based on observed outcomes and evolving business or target audience needs. To make this as accurate as possible, keep making these surveys either sporadically or regularly (e.g., annually).

Wrapping up

Implementing surveys and gathering actionable feedback is essential for the growth of your startup. By understanding your startup journey and product life-cycle, and aligning it with feedback, you can navigate roadblocks more efficiently and drive your business forward in a more meaningful and realistic way.

Take advantage of the provided survey questions to collect valuable insights from your audiences. Remember, these surveys can be used as a growth engine, whether you're in the early stages of establishing a Product/Market-Fit or experiencing rapid growth. Customize the questions to align with your startup's unique requirements or goals, and leverage the power of close and constant communication with your audience to stay on top of their expectations, needs, or even new problems your product could solve.

forms.app, your free form builder

- Unlimited views

- Unlimited questions

- Unlimited notifications