Surveys generally serve as a valuable tool that allows you to understand your audience's concerns, expectations, and experience. In this sense, mortgage research also speeds up the mortgage process as a mortgage lender and allows you to save time and resources. It also helps you understand your buyers better and improve customer satisfaction by troubleshooting potential problems.

In this article, you can find a lot of valuable information about mortgage surveys for your organization. We include answers to questions about what a mortgage survey is and how it is created. It contains tips to consider when creating a mortgage survey. You can also find 40+ essential mortgage survey questions and free templates. So, let's start learning all about it.

First things first: What is a mortgage survey?

Mortgage surveys are a valuable tool that financial institutions or government agencies can use to gather opinions and learn about the mortgage process, their experience with lenders, and their level of satisfaction with the service they receive.

Through these surveys, you can evaluate your customers' satisfaction level and understand the negatives and benefits they experience regarding mortgage and home ownership. Surveys can also provide information about your target audience's knowledge and mortgage awareness.

40+ Must-ask questions to ask in a mortgage survey

The questions you ask in the mortgage survey and the answers you get accordingly allow your organization to better understand your target audience, increase customer satisfaction, and develop an accurate strategy. In this regard, choosing the right questions plays an important role. Below, we have shared more than 40+ mortgage survey questions that will increase the response rate and data quality:

1. Please specify your gender

2. Please specify your age group

3. Please indicate your monthly income

4. Please specify your type of work.

5. How much do you know about mortgages?

6. Where did you learn the information you have about mortgages?

- Online research

- From a family member or friend

- From a financial advisor

- From a real estate agent

- From a bank or lender

- From a mortgage broker

- From a home buying seminar or workshop

- From personal experience

7. Do you know how mortgages work?

8. Do you think mortgage lenders are supportive?

9. Are you currently using an existing mortgage?

10. What was your last reason for getting a mortgage?

- Purchasing a new home

- Refinancing an existing mortgage

- Investing in a rental property

- Consolidating debt

- Doing a home inspection

- Buying a vacation home

- Assisting with a family member's home purchase

- Building a new home

- Taking advantage of low interest rates

11. Have you taken out a mortgage loan in the last 3 years?

12. Can you stop making mortgage payments whenever you want?

13. Which of the following points is the most critical factor when choosing a mortgage lender?

- Interest rate

- Loan terms

- Customer service

- Reputation

- Flexibility

- Closing costs

- Availability of loan options

- Ease of application process

- Ability to pre-qualify

- Online tools and resources

14. How did you find the financial institution or lender to get your mortgage?

- Online title search engine

- Referral from a friend or family member

- Recommendation from a real estate agent

- Bank or credit union

- Mortgage broker

- Advertisement or marketing campaign

- Previous experience with the institution or lender

- Comparison shopping and research

- Word of mouth

- A financial advisor or accountant

15. What types of lenders did you contact when you applied for a mortgage?

- Banks

- Credit unions

- Online lenders

- Mortgage brokers

- Private lenders

- Government agencies

- Non-profit organizations

- Friends or family members

- Real estate agents

- Financial advisors

- Title companies

16. How many lenders have you compared before getting a mortgage?

- 5-15

- 15-25

- 25-35

- 35-45

17. Do you think you're getting the best mortgage deal?

18. Do you think your mortgage lender is knowledgeable and trustworthy?

19. Do you think the monetary value of the property you are mortgaged for is appraised?

20. What type(s) of property did you take out the mortgage for?

- Residential property

- Commercial property

- Vacation property

- Rental property

- Land

- Multi-family property

- Condominium

- Townhouse

- American land title

21. What is the minimum amount of interest you pay over the life of a mortgage?

- Fixed interest rate

- Adjustable interest rate

- Interest-only payments

- Principal and interest payments

- 15-year mortgage

- 30-year mortgage

- 40-year mortgage

- Bi-weekly payments

- Accelerated payments

22. What do you think is the best tenure for a mortgage?

- 10 years

- 15 years

- 20 years

- 25 years

- 30 years

- 35 years

- 40 years

23. Which type of monthly mortgage can change over time?

- Adjustable Rate Mortgage (ARM)

- Variable Rate Mortgage

- Interest-Only Mortgage

- Graduated Payment Mortgage

- Shared Appreciation Mortgage

- Convertible Mortgage

- Buydown Mortgage

- Step-Rate Mortgage

- Seasonal Mortgage

- Blanket Mortgage

- Pledged Account Mortgage

- Shared Ownership Mortgage

24. What is the most challenging part of the mortgage process?

- Understanding the complex terminology and jargon used in mortgage contracts

- Gathering and organizing all necessary financial documents

- Finding the best interest rate and loan terms for your specific financial situation

- Dealing with unexpected delays or roadblocks during the approval process

- Understanding and comparing different types of mortgages

- Calculating and budgeting for all associated fees and closing costs

- Keeping up with changing mortgage regulations and requirements

- Managing the stress and pressure of making such a significant financial decision

25. What changes did you see in payment and closing costs from when you got your mortgage until you closed?

- Decrease in payment and closing costs

- Increase in payment and closing costs

- Minimal changes in payment and closing costs

- Unexpected changes in payment and closing costs

- Negotiated changes in payment and closing costs

- Changes due to market conditions

- Changes due to credit score improvement

26. When you encountered difficulties paying your mortgage, did you consult a professional advisor?

27. What challenges did you encounter that made paying the mortgage difficult?

- Job loss or reduced income

- Unexpected expenses

- Illness or medical bills

- Divorce or separation

- High interest rates

- Adjustable rate mortgage

- Property line value decrease

- Difficulty refinancing

- Inability to sell property

- Lack of savings or emergency fund

28. Do you think a mortgage is the best solution for buying a house?

29. Do you think owning a home is a good financial decision?

30. Do you think late payments have an impact on credit score?

31. How much will your monthly payments change over the next few years?

- May increase.

- May decrease.

- May stay the same over.

- May be impacted by changes in interest rates.

- May be affected by changes in your loan terms.

- May be influenced by changes in your financial situation.

- May be subject to adjustments.

32. What will your mortgage loan process change over the next few years?

- Introduction of the digital mortgage application process

- Increase in online mortgage lenders

- Use of artificial intelligence in mortgage underwriting

- Shift towards paperless mortgage documentation

- Introduction of new mortgage products to cater to changing market needs

- Increase in remote mortgage closings

- Adoption of biometric authentication for mortgage applications

- Integration of mortgage process with other financial services

33. How much of your gross monthly income do you think you should spend on mortgages?

- 20%

- 30%

- 40%

- 50%

- 60%

- 70%

- 80%

- 90%

- 100%

34. Is it possible to buy a home in a price range of less than 10%?

35. What do you think the prices of properties in your neighborhood will be?

- Higher than current prices

- Lower than current prices

- Stable

- Dependent on market trends

- Influenced by local developments

- Affected by economic conditions

- Tied to interest rates

- Dependent on demand and supply

- Impacted by government policies

36. Considering all your experience, how likely are you to recommend a mortgage to family or friends?

37. What is the most crucial factor when choosing a mortgage loan?

- Interest rate

- Loan term

- Type of mortgage (fixed or adjustable)

- Down payment amount

- Closing costs

- Credit report

- Lender reputation

- Loan amount

- Monthly payment amount

- Prepayment penalties

38. Considering your recent experience, when would you take out another mortgage?

- Within the next year

- In the next 2-5 years

- In the next 5-10 years

- In the next 10+ years

- I would not take out another mortgage

39. What do you see as the reason you no longer have a mortgage?

- Paying off the mortgage in full

- Refinancing the mortgage

- Selling the property and paying off the mortgage

- Winning a legal case and using the settlement to pay off the mortgage

- Defaulting on the mortgage and losing the property

- Taking out a reverse mortgage and using the funds to pay off the existing mortgage

- Having the mortgage paid off by a family member or friend

40. Please let me know if you have any questions, concerns, or comments about your mortgage.

How to create a mortgage survey for free (in 5 steps)

You just learned about 40+ questions and why you need to ask them in your mortgage survey. It's time to learn how to create a mortgage survey using the forms app. By following the 5 steps below, you can create your mortgage survey and understand the problems of interest in mortgages and home ownership.

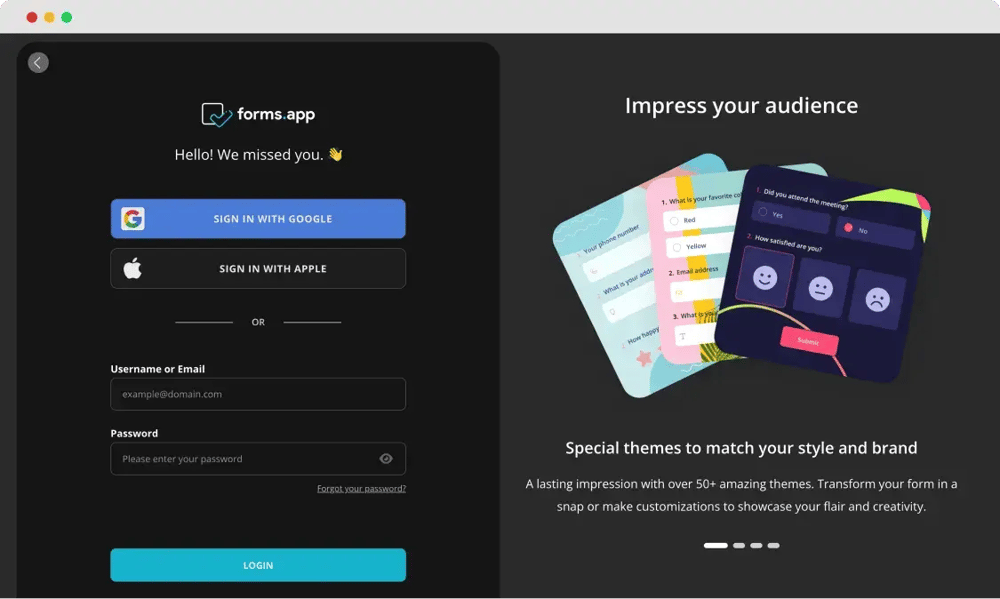

Step 1: Log in or sign up for forms.app

Login to your account

You can start to create your mortgage survey by signing up for an account using the forms app. You can create a free account in seconds if you don't have one. You can go directly to the platform if you already have an account. Apart from these, the forms.app allows you to log in using your Google, Apple, or Facebook accounts.

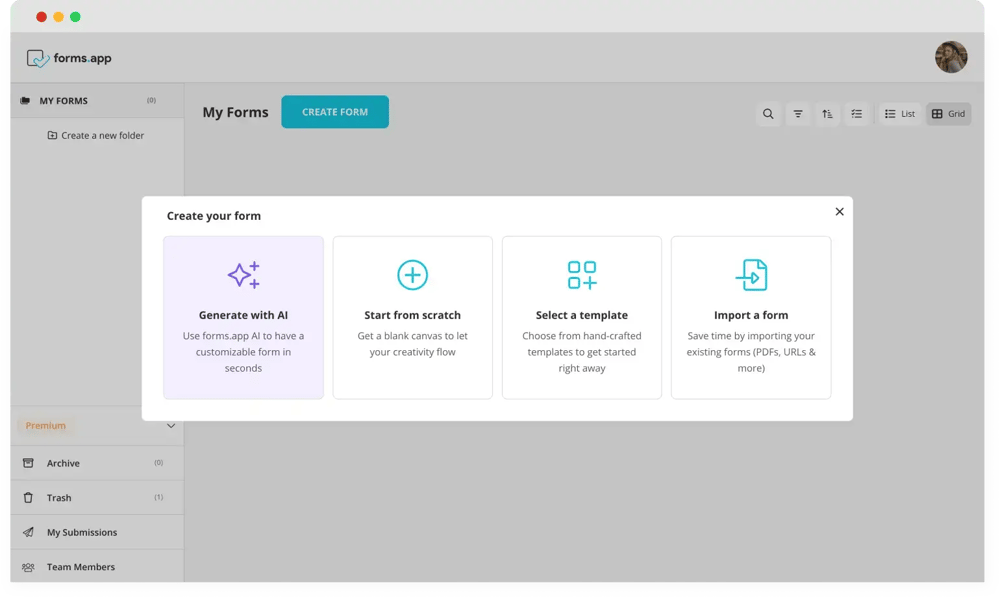

Step 2: Start from scratch, choose a template, or generate with AI

Choose a beginning option

Once logged in, click the Create Form button to create a new form. You can create your mortgage survey for free according to your goals. You can also use the ready-made mortgage application form template on the forms.app. Also, you can get help from forms.app AI for creating your survey.

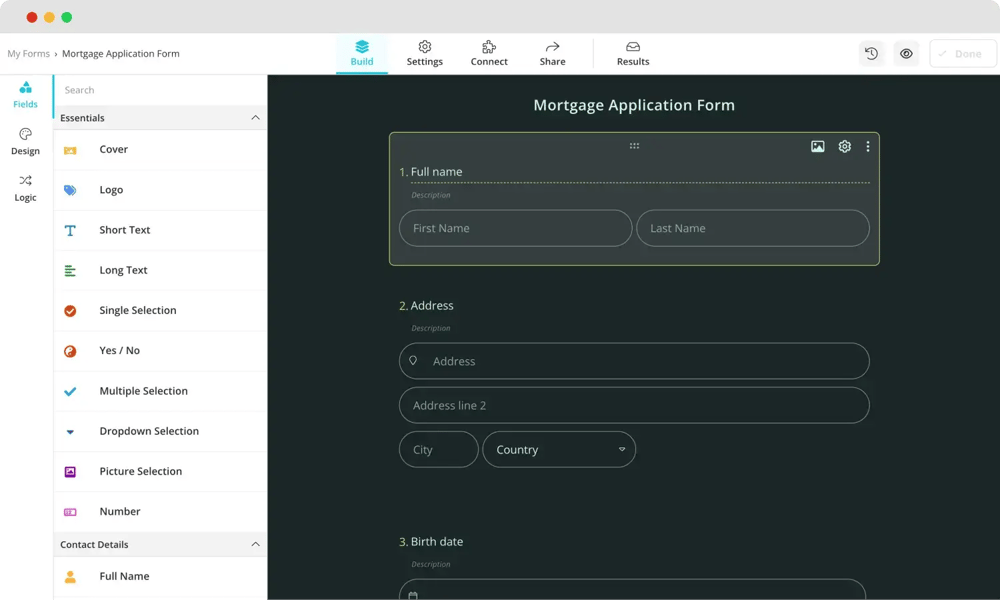

Step 3: Add your questions

Add your mortgage questions

You can add your mortgage survey questions once you choose a template that fits your goals. Based on your goals, you can use the 40+ mortgage survey example questions above in your survey. The forms app offers a variety of question types, such as multiple-choice, short-answer, and long-answer. Combining question types helps you better understand your participants.

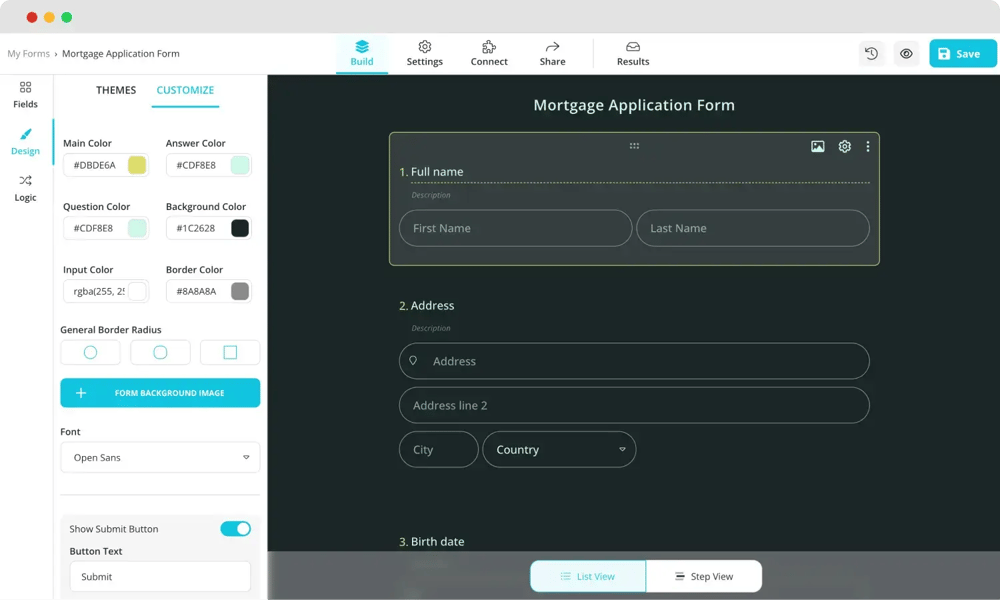

Step 4: Customize your form design

Customizing the design of your survey

Now that you've added your questions, it's time to design your survey. Thanks to the rich content offered by the forms.app, you can change the survey's look as you wish. The design field provides many options for styling your survey. You can easily select a theme and change colors. You can also choose your form images, logo, and cover. Finally, you can tailor colors, fonts, and other design tools.

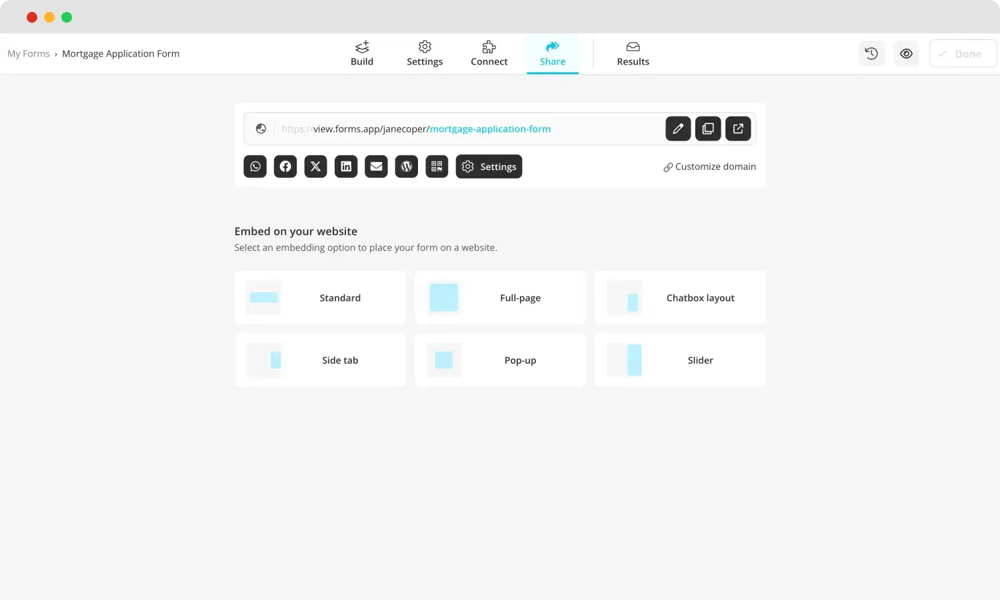

Step 5: Share your survey and analyze the results

You can use sharing options to distribute your survey to your participants. forms.app provides various sharing options. You can share your survey on popular social media platforms like Facebook, Twitter, LinkedIn, and WhatsApp. You can also embed surveys on your website or share them using QR codes.

Share your survey

Once you have gathered sufficient data, you can use the forms.app’s features, characteristics, and filters to analyze survey results. Analyzing the mortgage survey results will help you craft a strategy that aligns with your targets.

7 tips for a better mortgage survey

Every type of survey directly communicates with your target audience, serving as a valuable issuing customer satisfaction tool. Conducting an effective mortgage survey is challenging and requires careful planning and implementation. You can follow some tips to enhance the effectiveness of your mortgage survey. You can see these tips below:

- You should clearly define your survey's objectives and goals. The specific target provides more accurate results.

- There are many online survey platforms on the Internet. You should choose the correct survey platform based on usability, mortgage survey cost, and other factors.

- Ask questions that address every stage of the mortgage process. It will allow you to gain a more comprehensive understanding of the participants's experience.

- You should structure your questions and use various question types. Your survey can include multiple-choice, open-ended, and rating scale questions. You can also group relevant questions.

- Reassure candidates about anonymity and confidentiality to get more honest answers and increase participation.

- People generally spend more time on their mobile devices. Making your survey mobile-friendly enhances the accessibility and comfort of participants in accessing your survey.

- Ensure your survey is short to save participants' time.

💡One of the most critical points that the mortgage lender should pay attention to during the mortgage process is conducting the necessary research, such as a topographic survey, boundary survey, or construction survey, for the type of property mortgaged.

Final words

Mortgage lenders carry out mortgage surveys for lending purposes. It allows the structures and boundaries of a property to be evaluated, as well as identifying potential legal issues and ensuring compliance. To get more comprehensive information about the buyer and benefit from the benefits of the mortgage survey, you can start creating your mortgage survey via forms.app.

In this article, we aimed to inform relevant organizations about mortgage surveys. You can learn how to create them and tips by reading our article. It would be best if you were asked the proper questions to conduct an effective mortgage survey. For this reason, we have prepared 40+ examples of mortgage survey questions for you to benefit from.

forms.app, your free form builder

- Unlimited views

- Unlimited questions

- Unlimited notifications