In today's highly competitive business environment, understanding the dynamics that shape market competition is crucial. These strategic planning tools provide valuable insights into the competitive forces that impact an industry. The models help businesses develop effective strategies to enhance their market position and navigate challenges, making it an essential tool for modern enterprises.

Today, we'll explore Porter's Five Forces, a powerful tool for analyzing market competition. We'll cover its components in detail, explain how to use it, provide real-world examples of Porter’s five forces, and discuss its advantages and disadvantages. Additionally, we'll outline the best scenarios for its application and answer frequently asked questions about this essential strategic planning tool.

First things first: What are Porter’s five forces?

Porter's Five Forces is a framework for analyzing the competitive environment of an industry.

Michael E. Porter developed Porter’s value chain in 1979. It identifies five key forces influencing profitability and competition: the threat of new entrants, the bargaining power of suppliers, the bargaining power of buyers, the threat of substitute products, and industry rivalry.

Understanding these forces helps businesses assess an industry's attractiveness and identify strategic opportunities and threats. By evaluating each force, companies can develop strategies to enhance their competitive position, mitigate risks, and capitalize on opportunities, ultimately leading to improved business performance and market success.

Porter’s five forces template: Explained

Porter's Five Forces model provides a comprehensive framework for analyzing the competitive landscape of an industry. By examining the five key forces that shape competition, businesses can gain insights into the factors influencing their market environment. These forces include the threat of new entrants, the bargaining power of suppliers.

It also involves the bargaining power of buyers, the threat of substitute products, and the intensity of industry rivalry. Understanding these forces allows companies to develop strategic responses to enhance their market position and achieve sustainable competitive advantage. Let's delve deeper into each of these forces to understand their impact on businesses.

Template of Porter’s 5 forces

1. Threat of new entrants

The threat of new entrants refers to the potential for new companies to enter an industry and increase competition. High entry barriers, such as substantial capital requirements, economies of scale, strong brand identity, and regulatory constraints, can deter new entrants. Conversely, low entry barriers make it easier for new competitors to enter the market.

Companies must assess the ease with which new entrants can disrupt their industry and develop strategies to strengthen their market position. For instance, investing in brand loyalty, innovation, and cost efficiencies can create barriers that protect against new competitors and maintain a company's competitive edge.

2. Bargaining power of suppliers

The bargaining power of suppliers examines the influence that suppliers have on the prices and quality of inputs. When suppliers are concentrated, have unique products, or can easily switch to other customers, their bargaining power increases. This can lead to higher costs for businesses.

To mitigate supplier power, companies can diversify their supplier base, develop long-term relationships, or even integrate vertically by acquiring suppliers. By understanding supplier dynamics, businesses can negotiate better terms, ensure a steady supply of quality materials, and maintain cost efficiency, thereby enhancing their overall competitiveness in the market.

3. Bargaining power of buyers

The bargaining power of buyers assesses the influence that customers have on a company's pricing and product quality. When buyers are few, large, or have many alternatives, their bargaining power is high, allowing them to demand lower prices or higher quality. To counteract this, companies can differentiate their products, enhance customer loyalty, or diversify their customer base.

Understanding buyer power helps your organization/business anticipate customer demands and adjust your strategies to retain market share and profitability. By focusing on customer satisfaction and creating unique value propositions, companies can reduce buyer power and foster long-term customer relationships.

4. Threat of substitute products

The threat of substitute products refers to the potential for customers to switch to alternative products or services that meet the same need. High availability of substitutes can limit an industry's profitability by placing a ceiling on prices. Companies must identify possible substitutes and analyze their competitive advantages.

To mitigate this threat, businesses can innovate, improve product quality, and enhance customer loyalty. Understanding the landscape of substitute products allows companies to differentiate their offerings and create unique value propositions that attract and retain customers, thereby maintaining their market position and profitability.

5- Industry rivalry

Industry rivalry examines the intensity of competition among existing firms. High rivalry, characterized by numerous competitors, slow industry growth, or lack of differentiation, can erode profits. Companies need to assess the competitive landscape and identify factors driving rivalry. Strategies to manage rivalry include improving operational efficiency, focusing on customer service, and differentiating products.

By understanding the dynamics of industry rivalry, your business can develop strategies to gain a competitive edge, reduce competitive pressures, and improve profitability. Effective management of industry rivalry is crucial for sustaining long-term success and achieving your strategic business objectives.

How to use Porter’s five forces diagram for your business

Now that we have an overview of Porter’s Five Forces analysis, let's delve into how to use this powerful tool in business. We'll guide you through six detailed steps to effectively apply this model and enhance your decision-making process.

Porter’s 5 forces steps to follow for your business

Step 1: Define the Industry

The first step in using Porter's Five Forces is clearly defining the industry you are analyzing. This involves identifying the boundaries of the industry, key products and services, and the primary competitors. A well-defined industry provides a clear context for analyzing the five forces and understanding the competitive dynamics.

By accurately defining the industry, businesses can focus their analysis on relevant factors and gain meaningful insights into the competitive environment. This foundational step ensures that the subsequent analysis is accurate and applicable to the specific market context.

Step 2: Identify the Key Players

Next, identify the key players within the industry, including competitors, suppliers, buyers, and potential new entrants. Understanding who the major stakeholders are helps in assessing their influence on the market. This step involves researching and mapping out the relationships between these players and the company.

By identifying key players, businesses can better understand the competitive pressures and opportunities within the industry. This comprehensive understanding of the market landscape allows for more accurate and strategic decision-making, helping businesses navigate the complexities of their competitive environment effectively.

Step 3: Analyze Each Force

Analyze each of the five forces in detail to understand their impact on the industry. Assess the threat of new entrants by examining entry barriers and potential new competitors. Evaluate supplier power by looking at the concentration and importance of suppliers. Analyze buyer power by considering the bargaining strength of customers.

Assess the threat of substitutes by identifying alternative products. Finally, evaluate industry rivalry by analyzing the intensity of competition. This detailed analysis helps businesses identify the most significant forces affecting their industry and develop strategies to address them, enhancing their competitive position and market success.

Step 4: Evaluate Industry Structure

Evaluate the overall industry structure based on the analysis of the five forces. Determine whether the industry is attractive or unattractive for business operations. An attractive industry typically has low threat levels for each force, while an unattractive industry has high threats.

This evaluation helps businesses understand the competitive landscape and the potential for profitability. By assessing the industry structure, companies can make informed decisions about entering or exiting a market, investing in specific areas, or developing strategies to improve their competitive position. This strategic evaluation is crucial for long-term business success.

Step 5: Develop Strategic Responses

Strategic responses to address the identified forces should be developed based on the analysis. For example, if supplier power is high, consider diversifying suppliers or integrating vertically. If the threat of substitutes is significant, focus on differentiating products and enhancing customer loyalty.

Developing strategic responses involves creating actionable plans to mitigate threats and capitalize on opportunities. By addressing the specific challenges identified in the analysis, businesses can improve their market position and competitive advantage. These strategic responses are essential for navigating the competitive environment and achieving sustainable business growth and profitability.

Step 6: Monitor and Adapt

Finally, ensure you continuously monitor the competitive environment and adapt strategies as needed. The business landscape is dynamic, and the forces influencing it can change over time. Regularly reviewing and updating the analysis ensures that strategies remain relevant and effective.

By staying vigilant and responsive to changes, businesses can maintain their competitive edge and adapt to new challenges and opportunities. This ongoing monitoring and adaptation are crucial for long-term success in a constantly evolving market. By incorporating flexibility and responsiveness into their strategic planning, companies can navigate uncertainties and sustain their competitive advantage.

Examples of Porter’s five forces

Understanding how these forces apply in real-world scenarios offers valuable insights into how businesses navigate competitive landscapes and shape their strategic decisions. We'll look at Porter’s Five Forces analysis examples from various industries to see how each force influences the business strategy and outcomes.

Company X: Tech Industry

Company X, a tech startup, used Porter's Five Forces to navigate its competitive landscape. By analyzing the threat of new entrants, they identified high entry barriers due to advanced technology requirements. They mitigated supplier power by establishing strong relationships with multiple suppliers.

Understanding buyer power, they focused on unique product features to differentiate themselves. By evaluating substitutes, they ensured continuous innovation. Managing industry rivalry, they adopted a customer-centric approach. This strategic analysis helped Company X achieve rapid growth and establish a strong market presence.

Company Y: Retail Industry

Company Y, a retail chain, leveraged Porter's Five Forces to enhance its market strategy. They assessed the threat of new entrants and fortified their brand loyalty to create high entry barriers. By diversifying their supplier base, they reduced supplier power.

Understanding buyer power, they introduced loyalty programs to retain customers. Analyzing substitutes, they expanded their product range. To address industry rivalry, they focused on exceptional customer service. This comprehensive analysis enabled Company Y to strengthen its competitive position, improve customer satisfaction, and drive business growth.

Company Z: Manufacturing Industry

Company Z, a manufacturing firm, applied Porter's Five Forces to optimize its operations. They evaluated the threat of new entrants and invested in cutting-edge technology to stay ahead. By negotiating long-term contracts, they mitigated supplier power. They understood the buyer power.

They also customized products to meet specific customer needs. Analyzing substitutes, they focused on quality improvements. Managing industry rivalry, they streamlined production processes to reduce costs. This strategic approach helped Company Z enhance efficiency, increase market share, and achieve sustainable profitability.

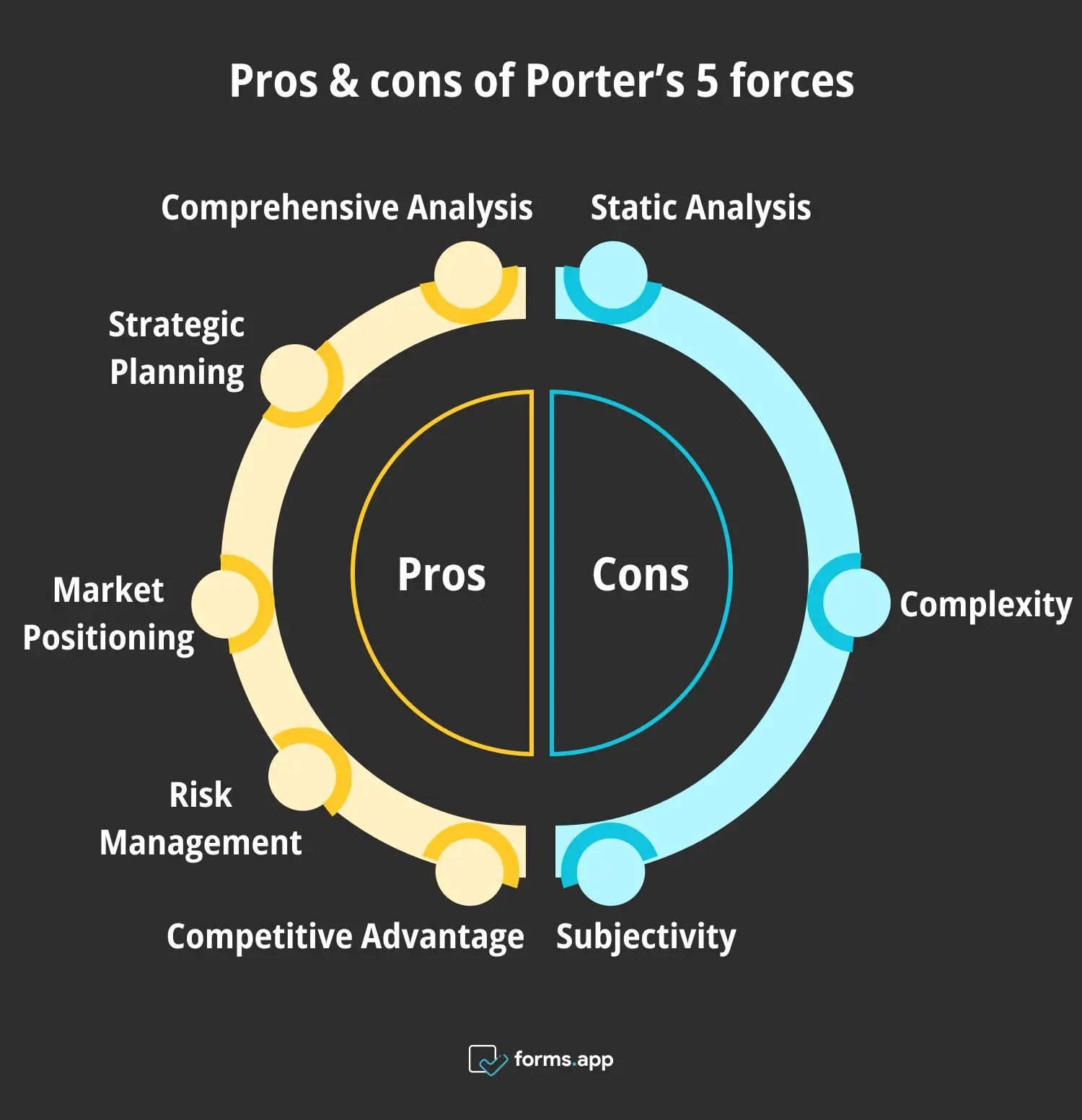

Pros and Cons of Porter’s Five Forces

Understanding the advantages and disadvantages of Porter’s Five Forces analysis is crucial. Let's explore how this model can benefit your business, along with some potential drawbacks, to help you make informed decisions and optimize your strategic planning and risk management efforts.

Advantages & Disadvantages of Porter’s 5 forces

Advantages

➕Comprehensive Analysis: Porter's Five Forces provides a thorough understanding of the competitive landscape, helping businesses identify key factors influencing their industry and develop effective strategies to navigate challenges and opportunities.

➕Strategic Planning: The model aids in strategic planning by highlighting areas where companies can leverage strengths, address weaknesses, capitalize on opportunities, and mitigate threats, leading to informed decision-making and better resource allocation.

➕Market Positioning: By understanding the competitive forces, businesses can position themselves more effectively in the market, differentiating their products and services to attract and retain customers and ultimately enhancing their market share and profitability.

➕Risk Management: The framework helps businesses identify potential risks in their industry, allowing them to develop strategies to mitigate these risks and safeguard against adverse impacts on their performance and stability.

➕Competitive Advantage: By analyzing the five forces, companies can identify areas where they can gain a competitive advantage, such as through innovation, cost efficiencies, or improved customer relationships, leading to sustainable business growth.

Disadvantages

➖Static Analysis: Porter's Five Forces is a static model that may not fully capture the dynamic nature of industries. Changes in market conditions, technology, and regulations can quickly alter the competitive landscape, requiring continuous updates to the analysis.

➖Complexity: The model requires comprehensive data collection and analysis, which can be time-consuming and resource-intensive. Smaller businesses with limited resources may find it challenging to conduct a thorough analysis.

➖Subjectivity: The effectiveness of the analysis depends on the accuracy and objectivity of the data used. Biases and inaccuracies in data collection and interpretation can lead to flawed strategic decisions.

When to use Porter’s Five Forces?

Knowing when to use Porter’s Five Forces analysis is key to maximizing its effectiveness. Here are specific scenarios and situations where this tool can provide valuable insights and guide your business toward successful and strategic decision-making.

Correct times to use Porter’s five forces

⏰Entering a new market: When a business is considering entering a new market, Porter's Five Forces helps assess the competitive landscape and determine the market's attractiveness, enabling informed decisions about market entry strategies and resource allocation.

⏰Strategic planning: During strategic planning, the model provides insights into the competitive forces shaping the industry, helping businesses develop effective strategies to enhance their market position and achieve long-term goals.

⏰Evaluating business opportunities: When evaluating new business opportunities, the framework helps identify potential risks and opportunities, allowing businesses to make informed investment decisions and pursue ventures with the highest potential for success.

⏰Competitive analysis: Conducting a competitive analysis using Porter's Five Forces helps businesses understand their competitors' strengths and weaknesses, enabling them to develop strategies to outperform rivals and gain a competitive edge.

⏰Identifying threats: The model helps businesses identify potential threats in their industry, such as new entrants or substitute products, allowing them to develop proactive strategies to mitigate these risks and protect their market position.

⏰Improving operational efficiency: By understanding the factors influencing supplier and buyer power, businesses can develop strategies to optimize their supply chain, negotiate better terms, and improve operational efficiency, leading to cost savings and increased profitability.

Frequently asked questions about Porter’s five forces

Now, we will find answers to some of the most frequently asked questions about Porter’s Five Forces analysis. These FAQs will help clarify any remaining doubts and provide additional insights into effectively applying this model in your business.

As Cinco Forças de Porter analisam a estrutura do sector e a intensidade da concorrência através do exame de cinco forças: rivalidade competitiva, poder do fornecedor, poder do comprador, ameaça de novos operadores e ameaça de produtos substitutos. A análise SWOT, por outro lado, avalia os pontos fortes e fracos internos e as oportunidades e ameaças externas de uma organização, proporcionando uma visão mais ampla do posicionamento estratégico e das acções potenciais.

A análise PESTLE examina os factores macro-ambientais - políticos, económicos, sociais, tecnológicos, legais e ambientais - que têm impacto numa empresa. As Cinco Forças de Porter centram-se nos factores microambientais que afectam a concorrência no sector. Enquanto a PESTLE fornece uma visão geral das influências externas, as Cinco Forças de Porter oferecem uma visão detalhada das forças competitivas dentro de uma indústria, ambas essenciais para um planeamento estratégico abrangente.

Um exemplo de risco e recompensa é o investimento numa empresa em fase de arranque. O risco é a perda potencial do capital investido se a start-up falhar. No entanto, a recompensa pode ser um retorno substancial se a empresa for bem sucedida e crescer significativamente. Este equilíbrio entre a perda e o ganho potenciais é um aspeto fundamental da análise do risco e da recompensa.

Um rácio risco-recompensa de 1,5 significa que, por cada unidade de risco, a recompensa potencial é 1,5 vezes esse valor. Por exemplo, se arriscar $100, pode ganhar $150. Este rácio ajuda os investidores e as empresas a avaliar se a recompensa potencial justifica o risco envolvido, ajudando a tomar decisões mais informadas.

Final words

Porter’s Five Forces analysis is a vital tool for businesses to balance potential gains with associated risks. By following structured steps, companies can make informed decisions, capitalize on opportunities, and mitigate threats. This article has covered the model in detail, including its steps, advantages, and suitable environments, and answered frequently asked questions, providing a comprehensive understanding of the concept.

In this article, we've explored Porter’s Five Forces analysis in depth, discussing its steps, advantages, and suitable environments. By understanding and applying this model, businesses can make better strategic decisions, balancing risks and rewards effectively. Now, it's your turn to implement these insights and drive your business forward.

Fatih is a content writer at forms.app and a translator specializing in many text domains, including medical, legal, and technical. He loves studying foreign languages. Fatih especially likes to create content about program management, organizational models, and planning tools.

Índice de Conteúdos

- First things first: What are Porter’s five forces?

- Porter’s five forces template: Explained

- How to use Porter’s five forces diagram for your business

- Examples of Porter’s five forces

- Pros and Cons of Porter’s Five Forces

- When to use Porter’s Five Forces?

- Frequently asked questions about Porter’s five forces

- Final words

11 min ler

11 min ler