Effective budget management is one of the influential factors that play an essential role in the success of any company. Companies' careful monitoring of their income and expenditures increases their profitability and contributes to their growth. For this reason, if you want your company to achieve your financial goals, you should pay attention to budget planning.

Creating a simple budget template in Google Sheets lets you easily track your income and expenses. It also enables you to analyze data while tracking the necessary figures and provides you with convenience. In this article, we will explain step by step how to create a budget spreadsheet for free in Google Sheets. Let's move on to our eye-opening article without wasting any more time.

What is a budget template in Google Sheets?

The budget template in Google Sheets is a table layout that you can create according to your needs and allows you to track your income and expenses.

The template can include your weekly, monthly, or annual budget, and you can shape the content as you wish. Thanks to the budget worksheets you will create, you can manage your money better and make your company more successful.

How do you create a budget template in Google Sheets? (step-by-step)

Using Google Sheets and Google Sheets formulas effectively will help you avoid confusion when collecting and analyzing your data. With a Google Sheets monthly budget template you create, you will successfully manage your budget and save money. By following the steps below, you can create spreadsheets for budgeting and ensure effective money management:

Step 1

Open a new spreadsheet

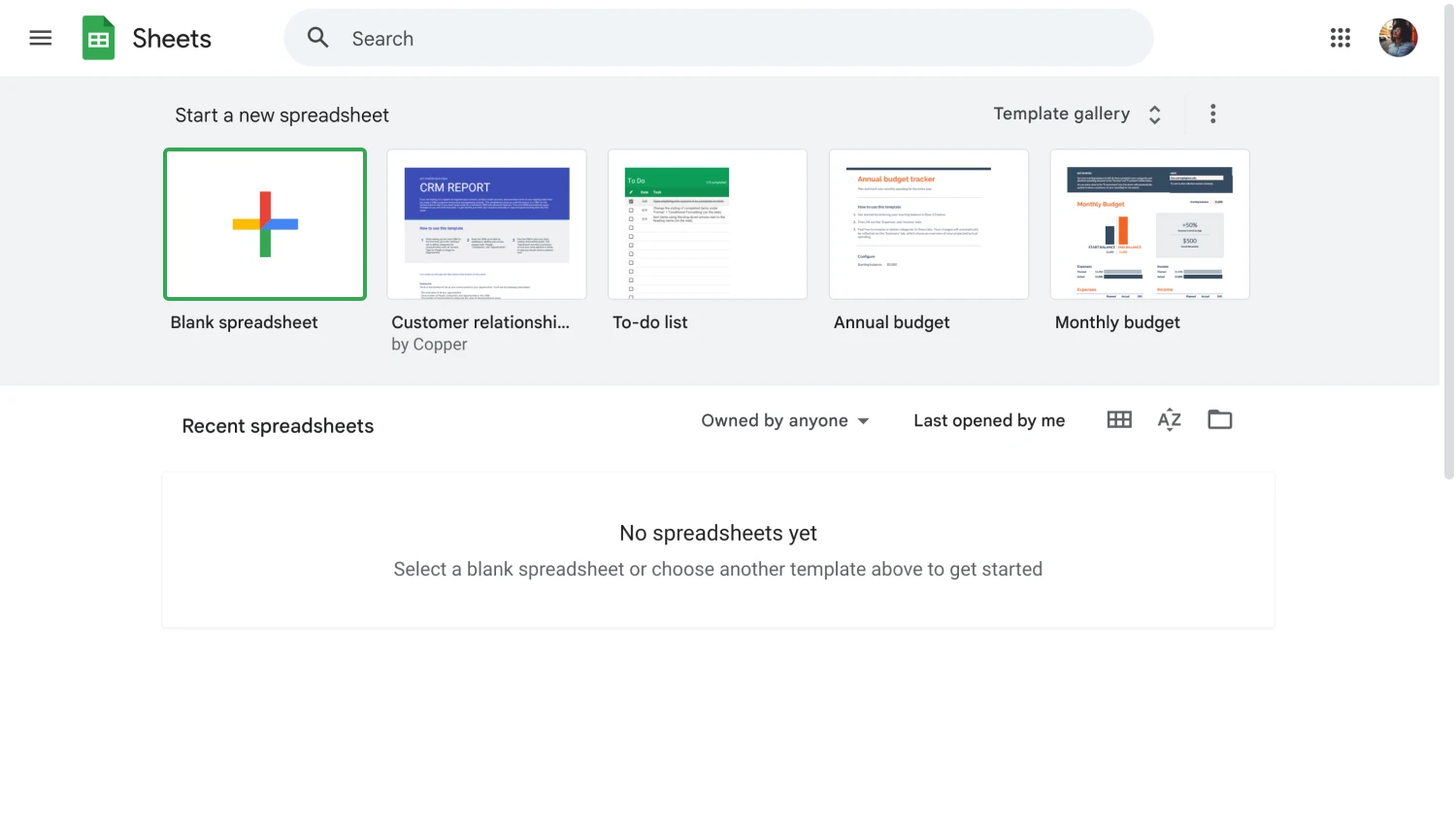

Open a new spreadsheet in Google Sheets. You can do this by going into Google Sheets and clicking on “blank spreadsheet.”

Step 2

Start editing your data

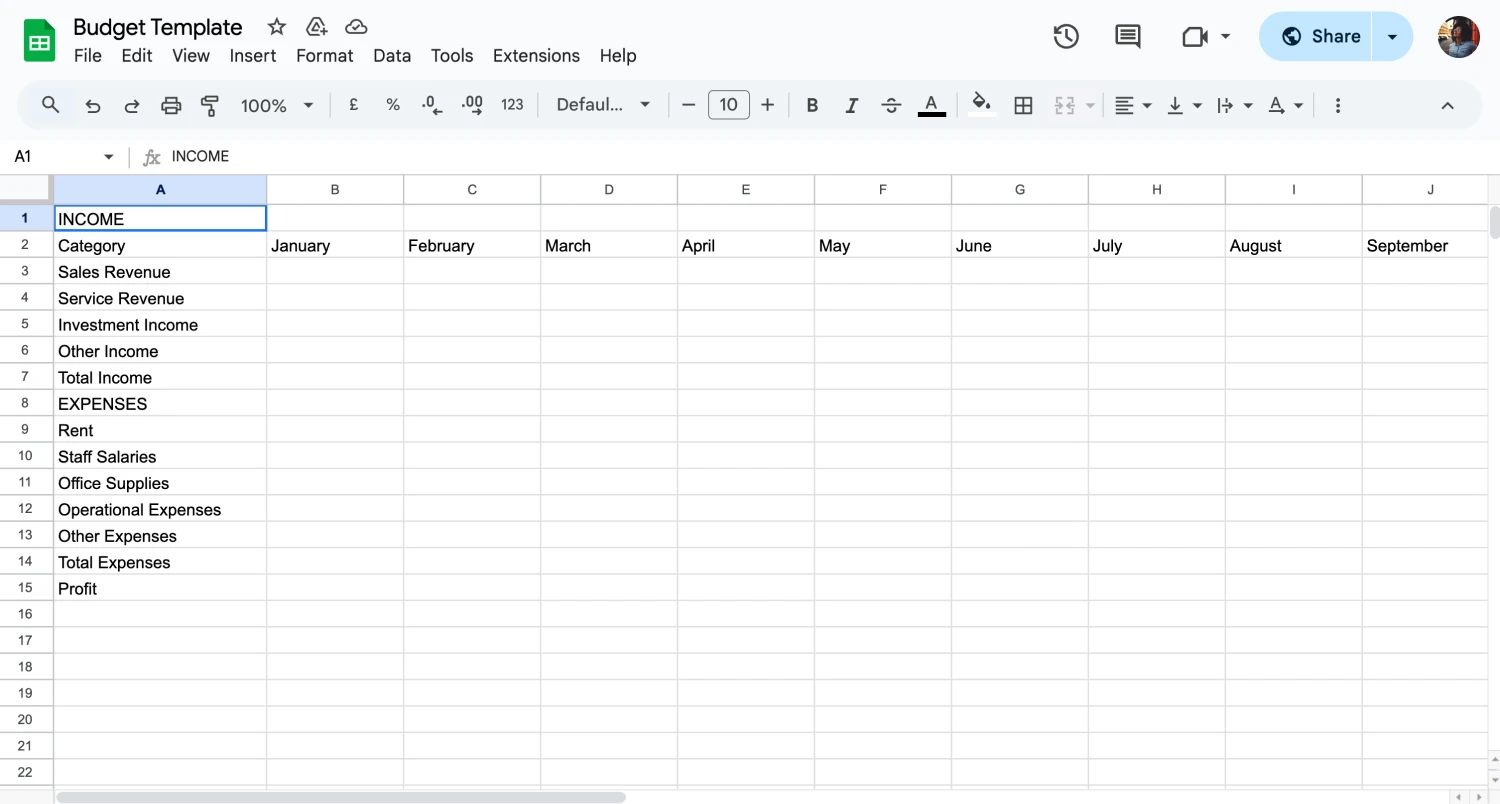

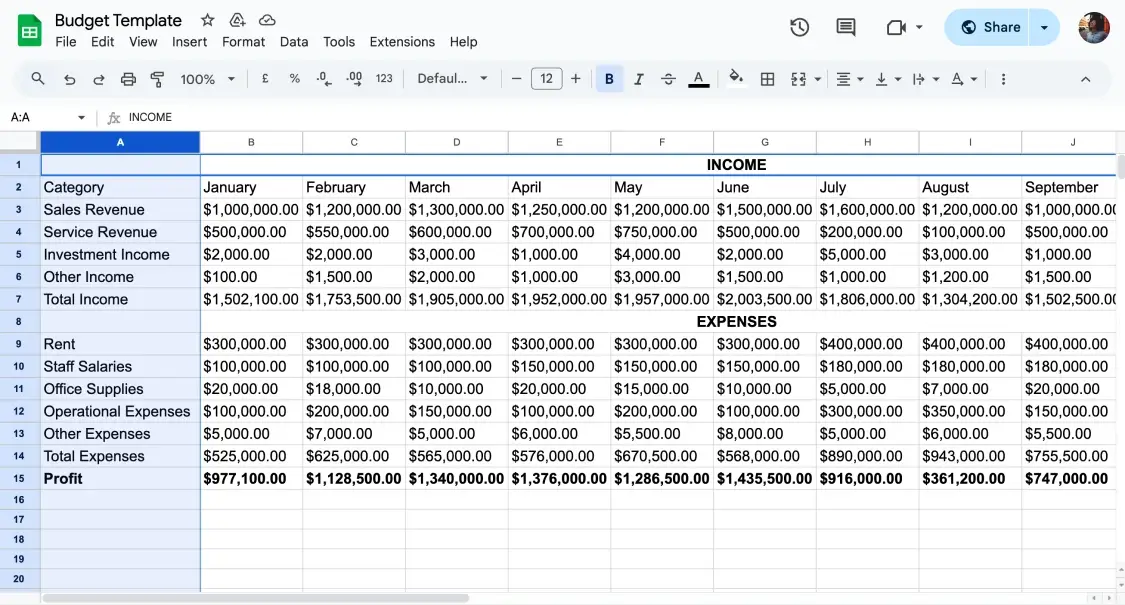

Select the budget categories you want to include in your table. You can diversify and detail these categories as you wish. These categories should consist of factors such as your revenues, monthly expenses, and profits. We have divided our sample template into two topics: revenues and expenses. Then, we detailed these topics by examining them under 5 sub-topics.

Step 3

Choose a budget template based on your needs

Choose the budget period you want to track your data. You can create an annual, monthly, or weekly budget planner template. Depending on the time period you choose, the frequency of analyzing your data will vary. Creating a monthly budget template like the one in our example can be ideal for your data analysis.

Step 4

Enter your financial data

Enter your financial data, such as your expenses and credit card debts, under the categories you have defined. With this data, you can examine and analyze your financial situation in detail.

Step 5

Use functions

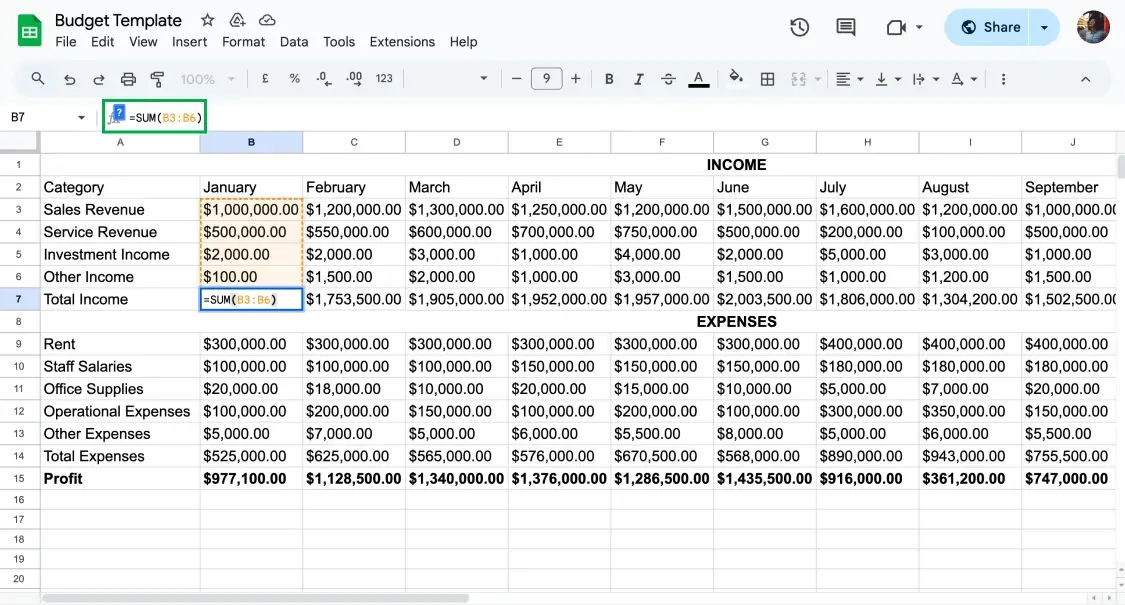

Use Google Sheets functions that will allow you to plan accurately in your spreadsheet. These functions will save you time when analyzing your data. For example, we used the “SUM” formula to aggregate the data under expenses and revenues and the “MINUS” formula to calculate the profit at the end of the month.

Step 6

Customize the table

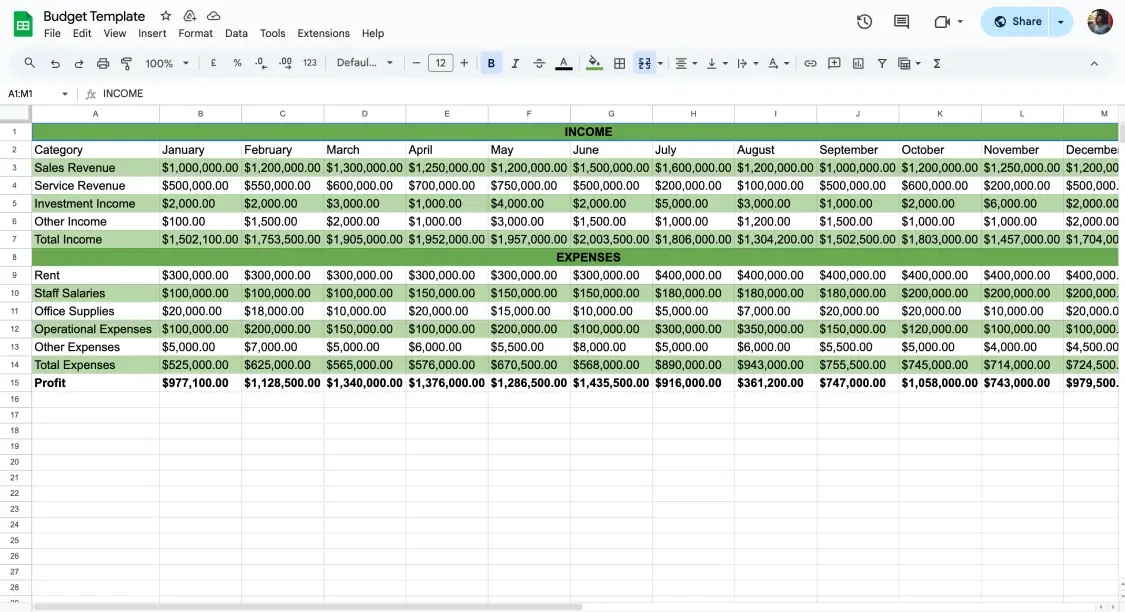

Customize and optimize your template to best suit your needs. Customizations such as coloring your template and highlighting necessary data will take your data analysis process to the next level.

Step 7

Update the data in the table you created according to the time period you set. In this way, you will be able to regularly analyze your budget and move your company forward financially.

4 expert tips while creating a budget template in Google Sheets

Using a self-created Google Sheets budget template gives you the opportunity to freely specify the data you want to analyze in this regard. A template with your parameters allows you to see and compare the data you need. However, there are some points to consider when creating your template that will make your work easier. Here are four expert tips to help you create a budget template:

💡Create simple templates

A budget template that is not simple and contains data you do not need can cause you to get lost in the numbers. Create a template that includes only the data that will allow you to track your finances and guide you on the necessary budget planning.

💡Be transparent when exporting data to a template

This way, you can have complete control over your finances and easily track your income and expenditure balance. The correct analyses you will make from the budget template you have created will enable you to plan both your business and your personal finances properly.

💡Use Google Sheets functions

As you can see from the sample template we have created, using formulas such as “SUM” and “MINUS” when analyzing the data in the table will save you time when making calculations.

💡Add charts and graphs to your template

Visualizing your template with the help of charts and graphs you will add will make your template more understandable and will provide you with convenience. You will also be able to make faster inferences and comparisons.

With the budget template you create by considering the above tips, you can track the financial situation of your individual and your business and make the necessary inferences. The inferences and planning you will make will enable you to keep your financial situation under control and will play a critical role in your company's success.

Frequently asked questions about creating a budget template in Google Sheets

Creating a budget template in Google Sheets and managing large data sets may raise some questions for you. This guide we have created for you will clarify all your questions and help you make the necessary planning. You can also take a look at this section, where we answer frequently asked questions that we have created to clear up your confusion.

Creating a personal budget template in Google Sheets allows you to manage your spending and financial budget better. To create your personal budget template, simply follow the steps described above for your company and adapt them to your personal budget template.

After opening a new worksheet, set your income and expense categories and select the budget period for which you want to review your spreadsheet. Then, enter the necessary data and create a spreadsheet with the formulas that will help you. Do not forget to update your data.

The 50 20 30 rule allows you to manage your budget correctly by dividing it into three different percentages. According to this rule, 50% of your budget should be allocated to basic needs, 20% to investments, and 30% to personal expenses. Adopting the 50 20 30 rule and applying it in your life will enable you to manage your money correctly.

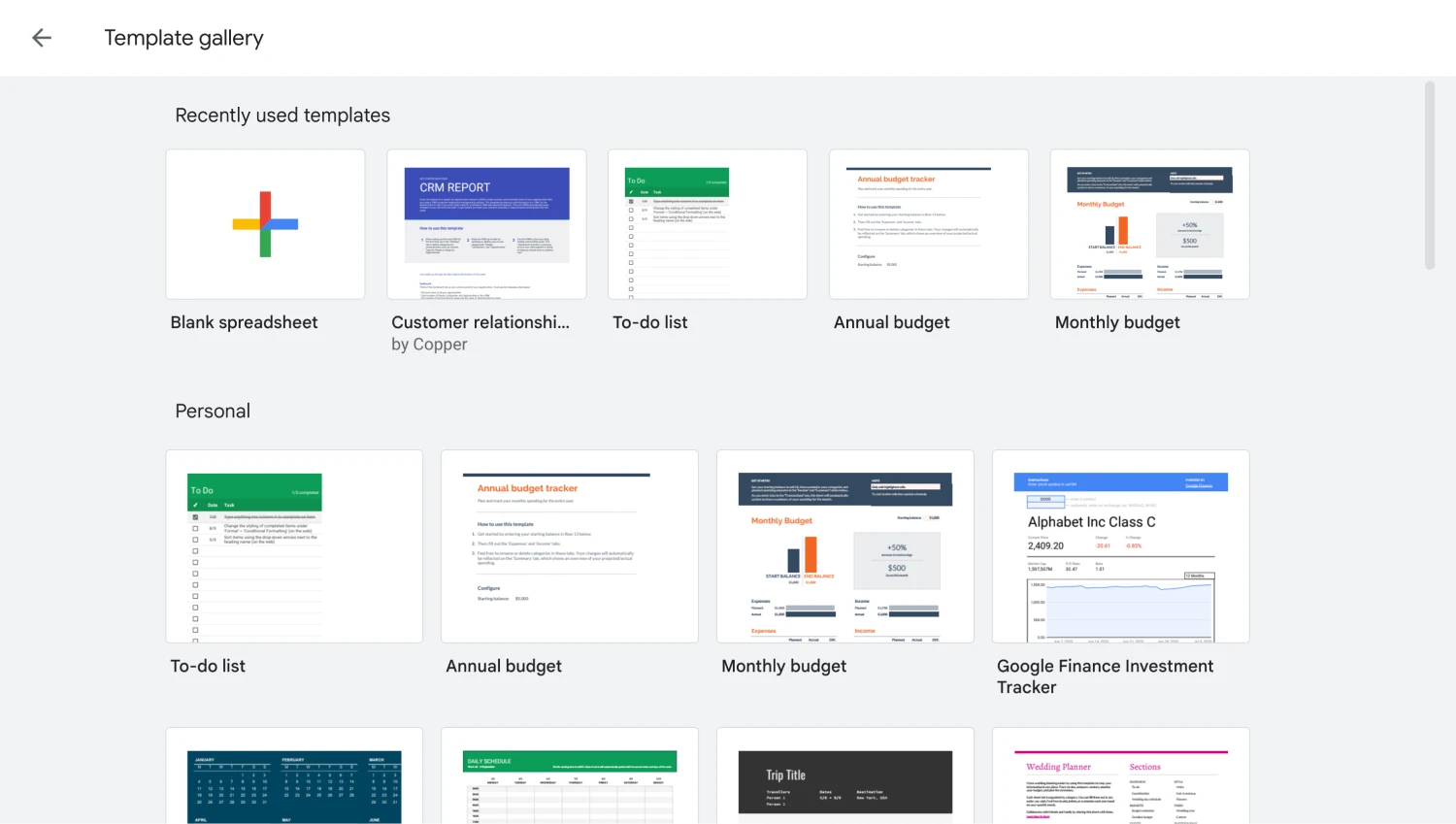

Yes, Google Sheets has a travel budget template. You can access this template by opening a new spreadsheet, then clicking on "Template Gallery" and selecting the required template. You can add the information you want to the template and make it more useful for you.

Key points to take away

Creating a budget template using Google Sheets will make it easier for you to do the necessary analyses and manage data. It will also assist in financial planning and setting goals for your company. In this article, you learned how to easily create a budget template for your company and yourself in Google Sheets.

Now that you have learned how to create a detailed budget template in Google Sheets, you are ready to lead your company to success!

Behçet is a content writer at forms.app. He is a music producer and enjoys blending electronic and acoustic tunes. Behçet has expertise in Google Sheets, survey questions, and online forms.